How to Avoid Scams on Cryptocurrency Exchanges

- Understanding the common types of scams on cryptocurrency exchanges

- Tips for researching and choosing a reputable cryptocurrency exchange

- How to verify the security measures of a cryptocurrency exchange

- Recognizing red flags and warning signs of potential scams

- Protecting your funds and personal information on cryptocurrency exchanges

- Steps to take if you have fallen victim to a cryptocurrency exchange scam

Understanding the common types of scams on cryptocurrency exchanges

When using cryptocurrency exchanges, it is crucial to be aware of the common types of scams that can occur. By understanding these scams, you can better protect yourself and your investments. Here are some of the most prevalent scams to watch out for:

- Phishing Scams: Phishing scams involve fraudulent emails or websites that mimic legitimate exchanges to steal your login credentials or personal information. Be cautious of any unsolicited emails or messages asking for your sensitive information.

- Pump and Dump Schemes: In pump and dump schemes, scammers artificially inflate the price of a cryptocurrency to attract investors and then quickly sell off their holdings, causing the price to crash. Avoid investing in assets that have been artificially hyped.

- Exchange Hacks: Exchange hacks occur when cybercriminals breach the security of a cryptocurrency exchange and steal users’ funds. To mitigate this risk, choose exchanges with robust security measures and consider storing your assets in a secure wallet.

- Ponzi Schemes: Ponzi schemes promise high returns on investments but use new investors’ funds to pay returns to earlier investors. Be wary of any investment opportunities that seem too good to be true and do your due diligence before investing.

- Impersonation Scams: Impersonation scams involve fraudsters posing as customer support representatives or reputable individuals to trick users into sending them cryptocurrency. Always verify the identity of the person you are communicating with before sharing any sensitive information.

By familiarizing yourself with these common scams, you can navigate the cryptocurrency landscape with greater confidence and security. Remember to stay vigilant, conduct thorough research, and never hesitate to reach out to the exchange’s official channels if you suspect any fraudulent activity.

Tips for researching and choosing a reputable cryptocurrency exchange

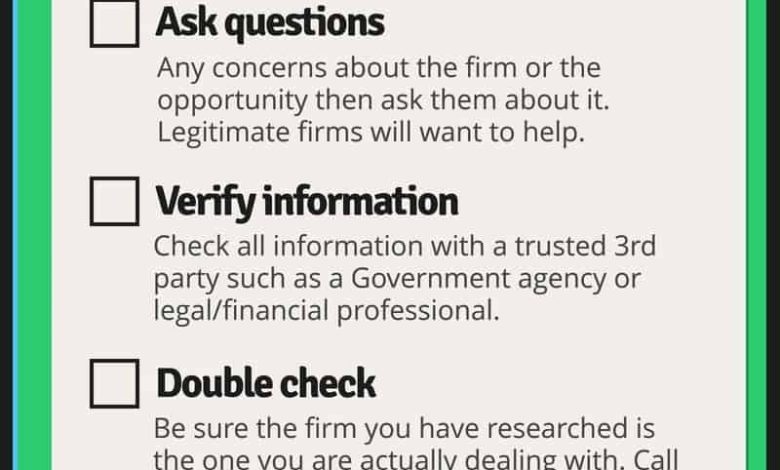

When researching and selecting a reputable cryptocurrency exchange, it is crucial to consider several factors to ensure the safety and security of your investments. Here are some tips to help you make an informed decision:

- Check the reputation of the exchange: Look for reviews and feedback from other users to gauge the trustworthiness of the platform.

- Verify the security measures: Ensure that the exchange has robust security protocols in place to protect your funds and personal information.

- Research the available cryptocurrencies: Make sure that the exchange offers a wide range of cryptocurrencies to trade, including popular options like Bitcoin and Ethereum.

- Compare fees and charges: Different exchanges have varying fee structures, so it is essential to understand the costs involved in trading on the platform.

- Check the customer support: A reliable exchange should have responsive customer support to assist you in case of any issues or concerns.

By following these guidelines and conducting thorough research, you can choose a reputable cryptocurrency exchange that meets your needs and provides a secure trading environment. Remember to stay vigilant and cautious when dealing with cryptocurrencies to avoid falling victim to scams or fraudulent activities.

How to verify the security measures of a cryptocurrency exchange

When it comes to using a cryptocurrency exchange, verifying the security measures in place is crucial to protect your investments. Here are some steps you can take to ensure the exchange you choose is secure:

- Check if the exchange has a two-factor authentication (2FA) option available for added security. This extra layer of protection can help prevent unauthorized access to your account.

- Look for exchanges that use cold storage to store the majority of their funds. Cold storage keeps the assets offline, making them less vulnerable to hacking attempts.

- Research the exchange’s security history and see if they have experienced any security breaches in the past. This can give you an idea of how seriously they take security measures.

- Ensure the exchange encrypts data transmission to protect your personal information from being intercepted by hackers.

- Check if the exchange has a bug bounty program in place, which incentivizes security researchers to report any vulnerabilities they find on the platform.

By following these steps and doing your due diligence, you can minimize the risk of falling victim to scams on cryptocurrency exchanges and trade with peace of mind.

Recognizing red flags and warning signs of potential scams

It is crucial to be able to recognize red flags and warning signs when it comes to potential scams on cryptocurrency exchanges. By staying vigilant and informed, you can protect yourself from falling victim to fraudulent schemes.

One common red flag to watch out for is promises of guaranteed high returns with little to no risk. If an offer sounds too good to be true, it probably is. Scammers often use this tactic to lure in unsuspecting investors.

Another warning sign is pressure to act quickly or fear of missing out on a great opportunity. Legitimate investments do not require immediate decisions, so be wary of anyone trying to rush you into making a financial commitment.

Be cautious of unverified or unlicensed exchanges that lack transparency or a solid reputation. Always do your research and choose reputable platforms with a proven track record of security and reliability.

Additionally, be wary of unsolicited offers or messages from unknown sources. Scammers often reach out via email, social media, or phone calls to entice individuals with fake investment opportunities. Never provide personal information or send money to someone you do not trust.

By staying informed and being aware of these red flags and warning signs, you can protect yourself from falling victim to scams on cryptocurrency exchanges. Remember to always exercise caution and do your due diligence before making any financial decisions.

Protecting your funds and personal information on cryptocurrency exchanges

When using cryptocurrency exchanges, it is crucial to take steps to protect your funds and personal information from potential scams. Here are some tips to help you safeguard your assets:

- Enable two-factor authentication (2FA) to add an extra layer of security to your account. This will require you to provide a second form of verification, such as a code sent to your phone, in addition to your password.

- Avoid sharing sensitive information, such as your private keys or passwords, with anyone. Legitimate exchanges will never ask you for this information.

- Be cautious of phishing attempts, where scammers try to trick you into revealing your login credentials or personal information through fake websites or emails. Always double-check the URL of the exchange website before entering any information.

- Keep your software up to date to protect against potential vulnerabilities that scammers could exploit. Regularly update your operating system, antivirus software, and any other programs you use to access your exchange account.

- Consider using a hardware wallet to store your cryptocurrency offline, away from potential online threats. This can provide an extra layer of security for your funds.

By following these precautions, you can help minimize the risk of falling victim to scams on cryptocurrency exchanges and protect your investments.

Steps to take if you have fallen victim to a cryptocurrency exchange scam

If you find yourself in the unfortunate situation of falling victim to a cryptocurrency exchange scam, it is crucial to take immediate action to protect yourself and potentially recover your funds. Here are the steps you should follow if you have been scammed:

1. **Cease all Transactions**: The first step is to stop any further transactions on the exchange platform where the scam occurred. This will help prevent additional losses and give you time to assess the situation.

2. **Contact the Exchange**: Reach out to the customer support team of the exchange and report the scam. Provide them with all relevant details, such as transaction IDs, dates, and amounts involved. They may be able to investigate the incident and provide assistance.

3. **File a Report**: It is essential to report the scam to the appropriate authorities, such as the police or financial regulatory bodies. This can help in tracking down the scammers and potentially recovering your funds.

4. **Seek Legal Advice**: Consider consulting with a legal professional who specializes in cryptocurrency scams. They can advise you on the best course of action to take, such as filing a lawsuit or seeking compensation through other means.

5. **Monitor Your Accounts**: Keep a close eye on all your financial accounts, including bank and cryptocurrency wallets, for any suspicious activity. Change your passwords and enable two-factor authentication for added security.

6. **Educate Yourself**: Use this experience as a learning opportunity to educate yourself about the common types of cryptocurrency scams and how to avoid them in the future. Stay informed about the latest security measures and best practices in the industry.

By following these steps, you can take control of the situation and work towards resolving the aftermath of a cryptocurrency exchange scam. Remember to stay vigilant and cautious when dealing with online transactions to protect yourself from falling victim to scams in the future.