The History and Evolution of Bitcoin

- The Origins of Bitcoin: A Brief History

- The Rise of Cryptocurrency: Bitcoin’s Emergence

- Bitcoin’s Impact on the Financial World

- The Evolution of Bitcoin: From White Paper to Global Phenomenon

- Challenges and Controversies in Bitcoin’s Development

- The Future of Bitcoin: Trends and Predictions

The Origins of Bitcoin: A Brief History

The creation of Bitcoin can be traced back to a person or group of people using the pseudonym Satoshi Nakamoto. **Bitcoin** was introduced in a whitepaper published in 2008, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This whitepaper laid out the framework for a decentralized digital currency that would operate without the need for a central authority.

In January 2009, the **Bitcoin** network was launched when Nakamoto mined the first block of the chain, known as the genesis block. This marked the beginning of **Bitcoin** transactions and the mining process that would secure the network.

**Bitcoin** gained traction among cryptography enthusiasts and those interested in **decentralized** technologies. The first real-world transaction using **Bitcoin** occurred in May 2010 when a programmer named Laszlo Hanyecz purchased two pizzas for 10,000 **Bitcoins**. This event is now celebrated as “Bitcoin Pizza Day” in the cryptocurrency community.

Over the years, **Bitcoin** has faced its share of challenges and controversies, including **security** breaches, regulatory scrutiny, and **volatility** in its price. However, it has also gained mainstream acceptance and adoption as a legitimate form of digital currency.

Today, **Bitcoin** continues to be the most well-known and widely used cryptocurrency in the world. Its underlying technology, blockchain, has inspired the development of thousands of other cryptocurrencies and **blockchain** projects. The **future** of **Bitcoin** remains uncertain, but its impact on the world of finance and technology is undeniable.

The Rise of Cryptocurrency: Bitcoin’s Emergence

The emergence of Bitcoin marked a significant milestone in the world of cryptocurrency. Bitcoin was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. It quickly gained popularity as a decentralized digital currency that could be used for peer-to-peer transactions without the need for intermediaries like banks or governments.

Bitcoin’s rise to prominence was fueled by a combination of factors, including its innovative blockchain technology, which provided a secure and transparent way to record transactions. As more people began to see the potential of Bitcoin as a store of value and a medium of exchange, its value started to soar. This led to a surge in interest from investors and speculators looking to capitalize on the growing popularity of cryptocurrency.

The increasing adoption of Bitcoin also led to the creation of numerous other cryptocurrencies, known as altcoins, which sought to improve upon the original Bitcoin protocol. Despite facing challenges such as regulatory scrutiny and security concerns, Bitcoin continued to grow in popularity and value, solidifying its position as the leading cryptocurrency in the market.

Today, Bitcoin is widely accepted as a form of payment by a growing number of merchants and businesses around the world. Its decentralized nature and limited supply have made it a popular choice for those looking to diversify their investment portfolios or hedge against traditional fiat currencies. As the cryptocurrency market continues to evolve, Bitcoin remains at the forefront, driving innovation and shaping the future of digital finance.

Bitcoin’s Impact on the Financial World

Bitcoin has had a significant impact on the financial world since its inception in 2009. This digital currency has revolutionized the way people think about money and transactions. One of the key aspects of Bitcoin is its decentralized nature, which means that it is not controlled by any government or financial institution. This has led to increased financial freedom for individuals who want to transact without the need for intermediaries.

Moreover, Bitcoin has also introduced the concept of blockchain technology, which is a decentralized and transparent ledger that records all transactions made with Bitcoin. This technology has the potential to revolutionize various industries beyond finance, such as supply chain management, voting systems, and healthcare.

Another important impact of Bitcoin on the financial world is its role as a store of value and investment asset. Many people see Bitcoin as a digital gold, a hedge against inflation, and a way to diversify their investment portfolios. This has led to the rise of Bitcoin as a legitimate asset class, with institutional investors and corporations starting to allocate funds to Bitcoin.

Overall, Bitcoin’s impact on the financial world has been profound, challenging traditional financial systems and opening up new possibilities for individuals and businesses alike. As Bitcoin continues to evolve and gain mainstream acceptance, its influence on the financial world is only expected to grow.

The Evolution of Bitcoin: From White Paper to Global Phenomenon

The evolution of Bitcoin began with the release of the white paper by an unknown person or group of people using the pseudonym Satoshi Nakamoto in 2008. This white paper outlined the concept of a decentralized digital currency that would operate without the need for a central authority.

Following the release of the white paper, the first Bitcoin software was released in 2009, allowing users to mine the cryptocurrency and make transactions using the peer-to-peer network. Bitcoin quickly gained popularity among tech enthusiasts and libertarians who were attracted to its promise of financial freedom and privacy.

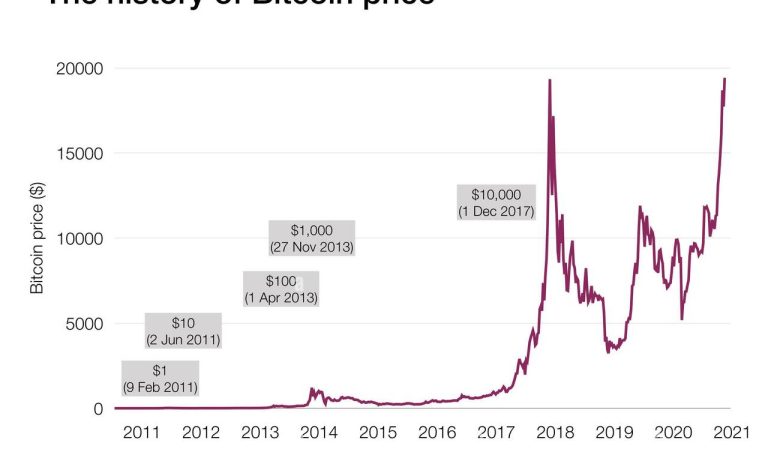

As Bitcoin gained traction, its value began to rise, leading to increased mainstream interest in the cryptocurrency. Over the years, Bitcoin has gone through several ups and downs, experiencing significant price fluctuations and regulatory challenges. However, it has also become more widely accepted as a form of payment and investment.

Today, Bitcoin is considered a global phenomenon, with a market capitalization in the hundreds of billions of dollars. It has inspired the creation of thousands of other cryptocurrencies and has sparked a revolution in the world of finance. Despite its challenges, Bitcoin continues to thrive and evolve, shaping the future of money and technology.

Challenges and Controversies in Bitcoin’s Development

Bitcoin’s development has not been without its challenges and controversies. One of the main issues that has plagued the cryptocurrency is scalability. As the popularity of Bitcoin grew, so did the number of transactions being processed on the network. This led to congestion and increased transaction fees, making it less practical for everyday use.

Another contentious issue in Bitcoin’s development is the debate over the block size limit. Some developers argue that increasing the block size would help alleviate congestion and reduce fees, while others believe that doing so would centralize the network and make it more vulnerable to attacks. This ongoing disagreement has led to a split in the community, resulting in the creation of Bitcoin Cash, a fork of the original Bitcoin blockchain.

In addition to technical challenges, Bitcoin has also faced regulatory hurdles and scrutiny from governments around the world. Concerns about money laundering, tax evasion, and the use of Bitcoin for illicit activities have led to increased regulation and oversight. This has created a tension between the decentralized nature of Bitcoin and the need for compliance with existing laws and regulations.

Despite these challenges and controversies, Bitcoin continues to evolve and adapt. Developers are constantly working on new solutions to improve scalability, security, and privacy. The community remains resilient and committed to the vision of a decentralized, peer-to-peer digital currency that is accessible to everyone. As Bitcoin’s journey continues, it will be interesting to see how it overcomes these obstacles and continues to shape the future of finance.

The Future of Bitcoin: Trends and Predictions

The future of Bitcoin is a topic of great interest and speculation in the cryptocurrency community. As the first and most well-known cryptocurrency, Bitcoin has paved the way for the development of numerous other digital currencies. Looking ahead, there are several trends and predictions that could shape the future of Bitcoin:

- Increased mainstream adoption: One of the most significant trends in the future of Bitcoin is the potential for increased mainstream adoption. As more people become familiar with and comfortable using cryptocurrencies, Bitcoin could see a surge in popularity.

- Regulatory developments: Another key factor that could impact the future of Bitcoin is regulatory developments. Governments around the world are still grappling with how to regulate cryptocurrencies, and new regulations could have a significant impact on the value and use of Bitcoin.

- Technological advancements: The future of Bitcoin will also be shaped by technological advancements. Improvements in scalability, security, and privacy could make Bitcoin an even more attractive option for users.

- Competition from other cryptocurrencies: As the cryptocurrency market continues to evolve, Bitcoin will face increasing competition from other digital currencies. While Bitcoin is currently the dominant player in the market, new cryptocurrencies could challenge its position in the future.

- Market volatility: Finally, market volatility will continue to be a defining feature of the future of Bitcoin. The price of Bitcoin has been known to fluctuate dramatically, and this trend is likely to continue as the market matures.

Overall, the future of Bitcoin is uncertain but full of potential. As the cryptocurrency continues to evolve and adapt to changing market conditions, it will be interesting to see how these trends and predictions play out in the years to come.