The Role of Tokenomics in Crypto Investing

- The Basics of Tokenomics and How It Impacts Crypto Investing

- Understanding the Relationship Between Tokenomics and Market Value

- The Importance of Tokenomics in Evaluating Cryptocurrency Investments

- Tokenomics Strategies for Successful Crypto Investing

- Tokenomics: A Key Factor in Assessing the Long-Term Viability of Cryptocurrencies

- How Tokenomics Can Influence Investor Behavior in the Crypto Market

The Basics of Tokenomics and How It Impacts Crypto Investing

Tokenomics is a term that refers to the economics of a cryptocurrency token. It encompasses various aspects such as the token’s distribution, supply, demand, and utility within its ecosystem. Understanding tokenomics is crucial for investors looking to make informed decisions in the crypto market.

Tokenomics plays a significant role in determining the value and potential growth of a cryptocurrency. By analyzing the tokenomics of a project, investors can assess its long-term viability and sustainability. Factors such as token distribution, inflation rate, and use cases can impact the token’s price and overall market performance.

Tokenomics also influences investor behavior and market dynamics. Tokens with a limited supply and high demand are likely to experience price appreciation, while those with excessive inflation or lack of utility may struggle to maintain value. By considering these tokenomics factors, investors can identify opportunities for profitable investments in the crypto space.

Understanding the Relationship Between Tokenomics and Market Value

Understanding the relationship between tokenomics and market value is crucial for investors in the cryptocurrency space. Tokenomics refers to the economics of a token, including its distribution, supply, demand, and utility. Market value, on the other hand, is the price at which a token is currently trading on the market.

Tokenomics plays a significant role in determining the market value of a cryptocurrency. A well-designed tokenomics model can create scarcity, increase demand, and drive up the price of a token. Factors such as token distribution, total supply, inflation rate, and utility all impact the market value of a token.

Investors should carefully analyze the tokenomics of a cryptocurrency before making investment decisions. By understanding how the token is distributed, how many tokens are in circulation, and what utility the token provides, investors can better predict the potential market value of the token.

The Importance of Tokenomics in Evaluating Cryptocurrency Investments

When it comes to evaluating cryptocurrency investments, one of the key factors to consider is tokenomics. Tokenomics refers to the economics of a token or cryptocurrency, including its distribution, supply, demand, and utility. Understanding tokenomics is crucial for investors as it can provide valuable insights into the potential long-term viability and growth prospects of a particular cryptocurrency.

Tokenomics plays a significant role in determining the value of a cryptocurrency and its potential for success in the market. By analyzing tokenomics, investors can assess the sustainability of a project, the incentives for holding the token, and the potential for price appreciation over time. This information can help investors make more informed decisions and mitigate risks associated with investing in cryptocurrencies.

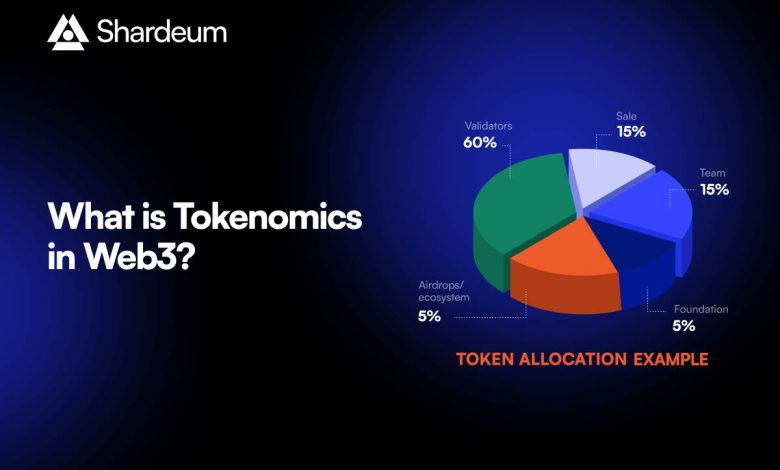

One of the key aspects of tokenomics to consider is the token distribution. A well-balanced distribution can help prevent centralization of control and promote a healthy ecosystem. Additionally, understanding the token supply and demand dynamics can provide insights into the potential for scarcity and value appreciation.

Furthermore, evaluating the utility of a token is essential in assessing its long-term value proposition. A token with real-world utility and a strong use case is more likely to attract users and investors, driving demand and ultimately increasing its value. By considering these factors, investors can gain a better understanding of the potential growth prospects of a cryptocurrency investment.

Tokenomics Strategies for Successful Crypto Investing

When it comes to successful crypto investing, having a solid understanding of tokenomics is crucial. Tokenomics refers to the economic model behind a cryptocurrency, including factors such as token distribution, supply, demand, and utility. By analyzing tokenomics, investors can make more informed decisions and increase their chances of success in the volatile crypto market.

There are several tokenomics strategies that investors can employ to maximize their returns:

- Diversification: Investing in a diverse range of cryptocurrencies can help spread risk and increase the chances of finding a successful project.

- Research: Conducting thorough research on a project’s tokenomics, team, technology, and market potential is essential before investing.

- Long-term perspective: Taking a long-term approach to investing can help investors weather market volatility and benefit from potential growth over time.

- Community engagement: Engaging with a project’s community can provide valuable insights into its potential for success and help investors stay informed about developments.

By incorporating these tokenomics strategies into their investment approach, investors can increase their chances of success in the crypto market. It is important to remember that crypto investing carries inherent risks, and thorough research and due diligence are essential to making informed investment decisions.

Tokenomics: A Key Factor in Assessing the Long-Term Viability of Cryptocurrencies

Tokenomics plays a crucial role in determining the long-term viability of cryptocurrencies. It refers to the economics of a token, including its distribution, supply, demand, and utility within a blockchain ecosystem. By analyzing tokenomics, investors can gain insights into the potential growth and sustainability of a cryptocurrency project.

One key factor to consider in tokenomics is the token distribution model. This model outlines how tokens are allocated among stakeholders, including developers, investors, and the community. A well-balanced distribution can help prevent centralization and promote decentralization, which is essential for the security and stability of a blockchain network.

Another important aspect of tokenomics is the token supply. The total supply of tokens, as well as the rate at which new tokens are minted or burned, can impact the value of a cryptocurrency. A limited supply can create scarcity and drive up demand, potentially leading to price appreciation over time.

Furthermore, the utility of a token is critical in assessing its long-term viability. Tokens that serve a clear purpose within a blockchain ecosystem, such as facilitating transactions, accessing services, or participating in governance, are more likely to retain value and attract users. A strong use case can differentiate a cryptocurrency from its competitors and contribute to its overall success.

In conclusion, tokenomics is a key factor that investors should consider when evaluating the potential of a cryptocurrency. By understanding the token distribution model, supply dynamics, and utility of a token, investors can make more informed decisions and position themselves for long-term success in the crypto market.

How Tokenomics Can Influence Investor Behavior in the Crypto Market

Tokenomics plays a crucial role in influencing investor behavior in the crypto market. By understanding the tokenomics of a particular cryptocurrency, investors can make more informed decisions about whether to buy, hold, or sell that asset. Tokenomics refers to the economics of a token, including factors such as its supply, distribution, utility, and governance.

One way in which tokenomics can influence investor behavior is through the token’s supply. A limited supply of tokens can create scarcity, driving up demand and potentially increasing the token’s value. On the other hand, an unlimited supply of tokens can lead to inflation and devaluation of the token. Investors may be more inclined to invest in a cryptocurrency with a limited supply to protect their investment.

Another factor that can impact investor behavior is the token’s distribution. If a large portion of the tokens is held by a small group of individuals or entities, it can lead to centralization and potential market manipulation. Investors may be wary of investing in such a token due to the concentration of power among a few holders.

Furthermore, the utility of a token can also influence investor behavior. Tokens that have clear use cases and provide tangible benefits are more likely to attract investors. For example, a token that can be used for staking, governance voting, or accessing a platform’s services may be more appealing to investors than a token with limited utility.

Lastly, the governance structure of a token can impact investor behavior. Tokens that offer holders a say in decision-making processes, such as protocol upgrades or changes, can create a sense of ownership and community involvement. This can lead to increased investor confidence and loyalty towards the token.