How to Identify and Avoid Cryptocurrency Scams

- Understanding the common types of cryptocurrency scams

- Tips for spotting red flags in cryptocurrency investment opportunities

- Researching the legitimacy of a cryptocurrency project before investing

- Protecting your digital assets from phishing and hacking attempts

- Avoiding Ponzi schemes and other fraudulent investment schemes in the crypto space

- Seeking advice from reputable sources to navigate the complex world of cryptocurrency scams

Understanding the common types of cryptocurrency scams

When it comes to cryptocurrency scams, it’s essential to understand the common types that exist in the digital world. By being aware of these scams, you can better protect yourself from falling victim to fraudulent schemes.

- Phishing Scams: One of the most prevalent types of cryptocurrency scams is phishing. Scammers often create fake websites or emails that mimic legitimate cryptocurrency platforms to trick users into providing their sensitive information, such as private keys or login credentials.

- Ponzi Schemes: Another common type of cryptocurrency scam is Ponzi schemes, where scammers promise high returns on investments but use funds from new investors to pay off existing ones. Eventually, the scheme collapses, leaving investors with significant losses.

- Initial Coin Offering (ICO) Scams: ICO scams involve fraudulent projects that raise funds through an initial coin offering but never intend to deliver on their promises. Investors end up losing their money when the project fails to materialize.

- Malware: Scammers use malware to gain access to users’ cryptocurrency wallets and steal their funds. Malware can be hidden in downloadable files, links, or even fake cryptocurrency trading apps.

- Impersonation Scams: In impersonation scams, scammers pose as legitimate figures in the cryptocurrency industry, such as influencers or executives, to deceive users into sending them funds. These scams often occur on social media platforms.

By familiarizing yourself with these common types of cryptocurrency scams, you can be more vigilant and cautious when engaging in the digital asset space. Remember to always verify the legitimacy of platforms and projects before investing your hard-earned money.

Tips for spotting red flags in cryptocurrency investment opportunities

When considering cryptocurrency investment opportunities, it is crucial to be aware of red flags that may indicate a potential scam. Here are some tips to help you spot these warning signs:

- Unrealistic promises: Be wary of investment opportunities that guarantee high returns with little to no risk. If it sounds too good to be true, it probably is.

- Lack of transparency: Legitimate cryptocurrency projects should have clear information about their team, technology, and goals. If this information is missing or hard to find, proceed with caution.

- Pressure to invest quickly: Scammers often try to create a sense of urgency to get you to invest before you have time to do proper research. Take your time and don’t let anyone rush you into a decision.

- Unsolicited offers: Be cautious of investment opportunities that come to you out of the blue, especially if they are from unknown sources. Do your own research before considering any offers.

- Complexity: If you don’t understand how the investment opportunity works or where your money is going, it’s best to stay away. Cryptocurrency investments should be easy to understand and transparent.

By keeping these tips in mind and staying vigilant, you can protect yourself from falling victim to cryptocurrency scams. Remember to always do your due diligence and never invest more than you can afford to lose.

Researching the legitimacy of a cryptocurrency project before investing

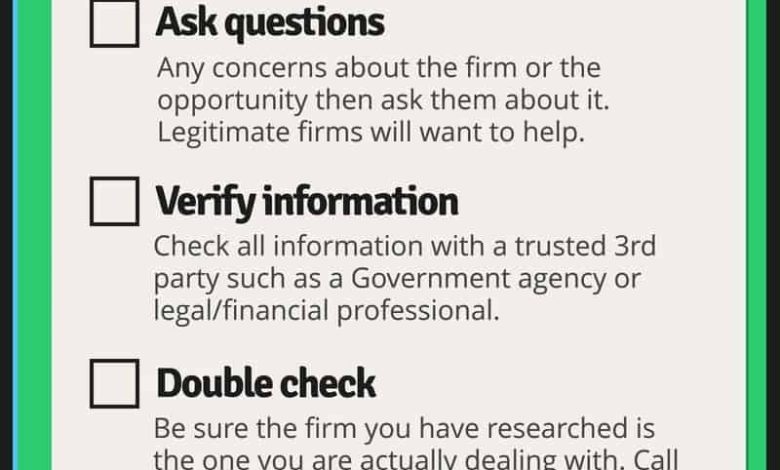

When considering investing in a cryptocurrency project, it is crucial to conduct thorough research to verify its legitimacy. There are several steps you can take to ensure that you are not falling victim to a scam.

One of the first things you should do is to examine the team behind the project. Look into their backgrounds, experience, and credibility in the cryptocurrency space. **Check** if they have been involved in any previous projects and whether those projects were successful. This information can give you insight into the team’s capabilities and intentions.

Next, **analyze** the whitepaper of the cryptocurrency project. The whitepaper should outline the technology, purpose, and goals of the project in detail. **Look** for any red flags such as vague or unrealistic claims, plagiarized content, or lack of technical details. A legitimate project will have a well-written and transparent whitepaper.

Furthermore, **research** the community surrounding the cryptocurrency project. Engage with other investors and experts in online forums and social media channels to get their opinions and insights. **Look** for any warning signs such as a lack of community engagement, negative reviews, or suspicious behavior.

Lastly, **verify** the project’s partnerships and collaborations. Legitimate cryptocurrency projects often have partnerships with reputable companies or organizations in the industry. **Check** if these partnerships are genuine and if they add credibility to the project. Be wary of projects that claim to have partnerships without providing any evidence.

Protecting your digital assets from phishing and hacking attempts

Protecting your digital assets from phishing and hacking attempts is crucial in the world of cryptocurrency. Here are some tips to help you secure your investments:

- Be cautious of unsolicited emails asking for your personal information or login credentials. Phishing scams often use suspicious emails to trick individuals into revealing sensitive data.

- Use a secure and unique password for each of your cryptocurrency accounts. Avoid using common passwords that can be easily guessed by hackers.

- Enable two-factor authentication (2FA) whenever possible. This adds an extra layer of security to your accounts by requiring a verification code in addition to your password.

- Keep your software and wallets up to date. Developers often release security patches to protect against vulnerabilities that hackers may exploit.

- Only use trusted exchanges and platforms to buy and trade cryptocurrencies. Research reviews and feedback from other users before transacting.

By following these best practices, you can minimize the risk of falling victim to scams and protect your hard-earned digital assets in the cryptocurrency market.

Avoiding Ponzi schemes and other fraudulent investment schemes in the crypto space

When investing in the cryptocurrency space, it is crucial to be vigilant and avoid falling victim to Ponzi schemes and other fraudulent investment schemes. These scams often promise high returns with little to no risk, luring in unsuspecting investors with the promise of quick profits.

One way to identify a Ponzi scheme is to look out for investment opportunities that guarantee consistent returns regardless of market conditions. **Scammers** often use new investors’ money to pay returns to earlier investors, creating a cycle that eventually collapses when new investments dry up.

Another red flag to watch out for is the lack of transparency in how the investment operates. Legitimate **cryptocurrency** investments should have clear documentation outlining their business model, team members, and how funds are being used. If this information is not readily available or seems vague, it could be a sign of a scam.

It is also essential to do thorough research before investing in any cryptocurrency opportunity. **Check** for reviews, news articles, and **forum** discussions to see if there are any red flags or warnings from other investors. Additionally, be wary of investments that pressure you to act quickly or keep information confidential.

By staying informed and being cautious, you can protect yourself from falling victim to Ponzi schemes and other fraudulent investment schemes in the cryptocurrency space. Remember, if an investment opportunity sounds too good to be true, it probably is.

Seeking advice from reputable sources to navigate the complex world of cryptocurrency scams

When it comes to navigating the complex world of cryptocurrency scams, seeking advice from reputable sources is crucial. With the rise of fraudulent schemes in the digital asset space, it is essential to arm yourself with knowledge from experts who can help you identify and avoid potential pitfalls.

One of the best ways to protect yourself from falling victim to cryptocurrency scams is to stay informed about the latest trends and developments in the industry. By following trusted news outlets, blogs, and forums, you can gain valuable insights into the red flags to watch out for and the best practices to follow.

Additionally, seeking advice from reputable financial advisors or cryptocurrency experts can provide you with personalized guidance on how to navigate the ever-changing landscape of digital assets. These professionals can help you assess the legitimacy of investment opportunities and steer clear of fraudulent schemes.

Remember, when it comes to safeguarding your hard-earned money in the world of cryptocurrency, knowledge is power. By seeking advice from reputable sources, you can arm yourself with the information you need to make informed decisions and protect yourself from falling victim to scams.