How to Spot and Avoid Pump-and-Dump Schemes

- Understanding the basics of pump-and-dump schemes

- Red flags to look out for when identifying pump-and-dump schemes

- Tips for avoiding falling victim to pump-and-dump schemes

- The role of social media in promoting pump-and-dump schemes

- Regulatory measures in place to prevent pump-and-dump schemes

- Case studies of infamous pump-and-dump schemes in the past

Understanding the basics of pump-and-dump schemes

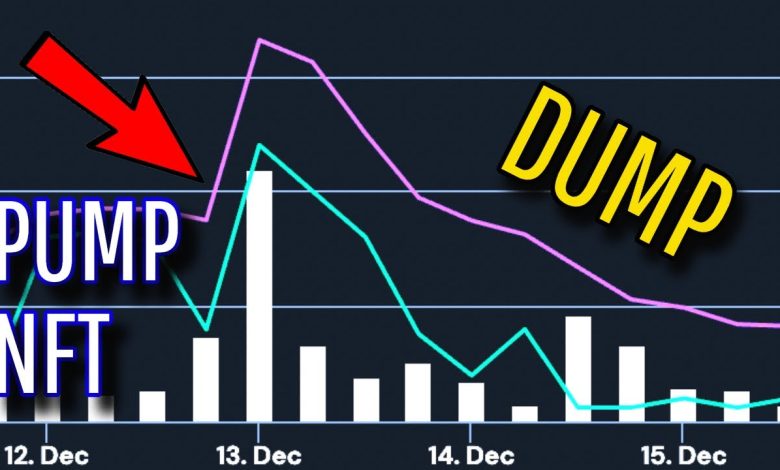

Pump-and-dump schemes are a type of investment fraud that involves artificially inflating the price of a stock or other asset through misleading statements and false promotions. This creates a buying frenzy among investors, causing the price to skyrocket. Once the price reaches a peak, the fraudsters behind the scheme sell off their shares at a profit, leaving unsuspecting investors holding worthless assets.

These schemes often target small, thinly traded stocks that are easy to manipulate. They typically involve spreading false information about the company’s prospects or engaging in aggressive marketing tactics to lure in unsuspecting investors. Pump-and-dump schemes can be conducted through social media, online forums, or even cold-calling campaigns.

To avoid falling victim to a pump-and-dump scheme, it is essential to understand the basics of how these schemes operate. By being aware of the warning signs and red flags associated with pump-and-dump schemes, investors can protect themselves from financial losses. It is crucial to conduct thorough research on any investment opportunity and to be wary of unsolicited investment advice or promises of guaranteed returns.

Red flags to look out for when identifying pump-and-dump schemes

One of the most important aspects of avoiding pump-and-dump schemes is being able to identify red flags that may indicate a scheme is in progress. By being aware of these warning signs, investors can protect themselves from falling victim to fraudulent activities. Some common red flags to look out for include **excessive promotional activity**, **sudden spikes in trading volume**, **unsubstantiated claims about the company**, **pressure to buy quickly**, and **insider selling**.

**Excessive promotional activity** is often a key indicator of a pump-and-dump scheme. If you see a stock being heavily promoted through **unsolicited emails**, **social media posts**, or **online forums**, it may be a sign that the stock is being artificially inflated.

**Sudden spikes in trading volume** can also be a red flag. If you notice a significant increase in trading activity without any corresponding news or developments, it could be a sign that the stock is being manipulated.

**Unsubstantiated claims about the company** are another warning sign to watch out for. If you come across **press releases** or **online articles** making bold claims about a company’s prospects without providing any evidence to back them up, it’s best to proceed with caution.

**Pressure to buy quickly** is a tactic often used in pump-and-dump schemes to create a sense of urgency among investors. If you feel like you’re being pushed to make a quick decision about a stock, take a step back and do your own research before investing.

**Insider selling** is another red flag to be aware of. If you notice that **company insiders** are selling off their shares while the stock price is being pumped up, it could be a sign that they know something you don’t. Pay attention to any **unusual selling patterns** among insiders and proceed with caution.

By staying vigilant and being aware of these red flags, investors can protect themselves from falling victim to pump-and-dump schemes. Remember to always do your own research and **consult with a financial advisor** before making any investment decisions.

Tips for avoiding falling victim to pump-and-dump schemes

When it comes to avoiding falling victim to pump-and-dump schemes, there are several tips to keep in mind. By being aware of the warning signs and taking proactive steps, you can protect yourself from being caught up in these fraudulent activities.

- Do your research before investing in any stock or cryptocurrency. Look into the company’s financials, management team, and overall reputation.

- Avoid stocks or cryptocurrencies that are being aggressively promoted on social media or through unsolicited emails. These could be part of a pump-and-dump scheme.

- Be wary of any investment opportunity that promises guaranteed returns or quick profits. If it sounds too good to be true, it probably is.

- Don’t fall for high-pressure sales tactics or fear of missing out (FOMO). Take your time to make informed decisions about your investments.

- Consider working with a financial advisor or investment professional who can provide guidance and help you navigate the complexities of the market.

By following these tips and staying vigilant, you can reduce your risk of falling victim to pump-and-dump schemes. Remember, it’s always better to be safe than sorry when it comes to your hard-earned money.

The role of social media in promoting pump-and-dump schemes

Social media plays a significant role in the promotion of pump-and-dump schemes. Scammers often utilize platforms such as Facebook, Twitter, and Instagram to spread false information about a particular stock, creating a sense of urgency and excitement among investors. They may use fake accounts or bots to artificially inflate the stock price, luring unsuspecting individuals to buy in at inflated prices.

These schemes can spread like wildfire on social media, with posts and messages going viral within minutes. The anonymity and reach of these platforms make it easy for scammers to target a large number of people quickly. Additionally, the use of hashtags and trending topics can further amplify the scheme’s visibility, making it even more enticing to potential victims.

It is essential for investors to be cautious when encountering investment opportunities promoted on social media. Conducting thorough research and due diligence before making any investment decisions can help individuals avoid falling victim to pump-and-dump schemes. Remember, if an investment opportunity seems too good to be true, it probably is. Stay vigilant and skeptical of information shared on social media, especially when it comes to investment advice.

Regulatory measures in place to prevent pump-and-dump schemes

One of the key ways to protect yourself from falling victim to pump-and-dump schemes is to be aware of the regulatory measures in place to prevent them. These measures are designed to safeguard investors and maintain the integrity of the financial markets.

**One** important regulatory measure is the enforcement of securities laws by regulatory bodies such as the Securities and Exchange Commission (SEC). The SEC works to detect and prosecute individuals and entities engaged in fraudulent activities, including pump-and-dump schemes. By holding wrongdoers accountable, the SEC helps deter others from engaging in similar illegal activities.

**Another** regulatory measure is the requirement for companies to disclose relevant information to investors. This includes providing accurate and timely financial reports, as well as disclosing any material information that could impact the company’s stock price. By ensuring transparency and accountability, regulators help investors make informed decisions and avoid falling prey to misleading information.

**Additionally**, regulators may impose trading restrictions or halt trading altogether on stocks that are suspected of being manipulated in a pump-and-dump scheme. These measures help prevent further harm to investors and allow regulators to investigate the suspicious activity. By taking swift action, regulators can limit the damage caused by fraudulent schemes and protect the integrity of the market.

In conclusion, regulatory measures play a crucial role in preventing pump-and-dump schemes and protecting investors from financial harm. By staying informed about these measures and being vigilant in your investment decisions, you can reduce the risk of falling victim to fraudulent schemes.

Case studies of infamous pump-and-dump schemes in the past

There have been several infamous pump-and-dump schemes in the past that serve as cautionary tales for investors. These schemes typically involve artificially inflating the price of a stock through misleading statements or promotions, only for the perpetrators to sell off their shares at a profit once the price has peaked.

- One such case is the Enron scandal, where executives engaged in accounting fraud to inflate the company’s stock price before it eventually collapsed.

- Another example is the Wolf of Wall Street scheme, where Jordan Belfort and his associates manipulated penny stocks to make millions before being caught by authorities.

- The Pump and Dump Kings case involved a group of individuals who used social media to hype up certain stocks, only to dump them once unsuspecting investors bought in.

These cases highlight the importance of being vigilant and doing thorough research before investing in any stock. By learning from the mistakes of the past, investors can better protect themselves from falling victim to pump-and-dump schemes.