What is Yield Farming and How Does It Work?

- Understanding the concept of Yield Farming

- Exploring the mechanics behind Yield Farming

- Maximizing returns through Yield Farming strategies

- The risks and rewards of participating in Yield Farming

- Comparing traditional investing with Yield Farming

- Key factors to consider before diving into Yield Farming

Understanding the concept of Yield Farming

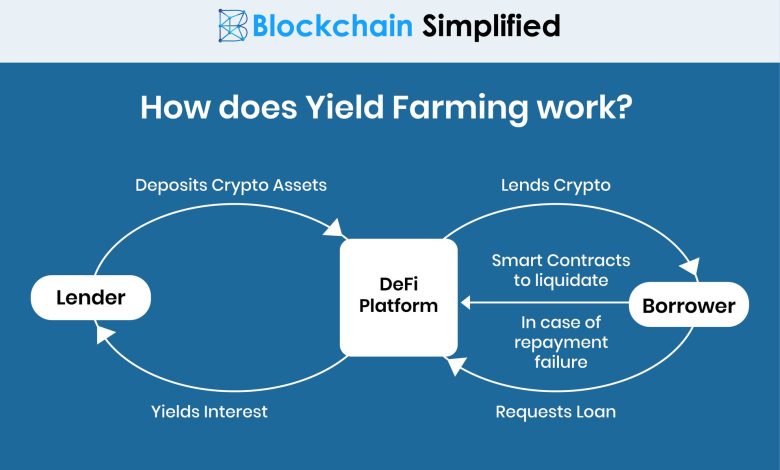

Yield farming is a concept in the world of decentralized finance (DeFi) that allows cryptocurrency holders to earn passive income by providing liquidity to various protocols. This process involves users lending their crypto assets to DeFi platforms in exchange for rewards in the form of additional tokens. Yield farming has gained popularity due to the potential for high returns, but it also comes with risks such as impermanent loss and smart contract vulnerabilities.

One of the key components of yield farming is liquidity mining, where users stake their tokens in liquidity pools to facilitate trading on decentralized exchanges. In return, they receive rewards in the form of governance tokens or other incentives. These rewards can then be reinvested to compound earnings, leading to potentially higher yields over time.

It is important for yield farmers to carefully research and understand the risks associated with each protocol before participating. Factors such as the project’s reputation, security audits, and tokenomics should be taken into consideration to mitigate potential losses. Additionally, staying informed about the latest developments in the DeFi space can help farmers make informed decisions and maximize their returns.

Exploring the mechanics behind Yield Farming

Yield farming is a complex process that involves various mechanics to generate returns on cryptocurrency holdings. One of the key components of yield farming is liquidity provision, where users provide funds to decentralized finance (DeFi) protocols in exchange for rewards. These rewards can come in the form of additional tokens, fees, or interest on the deposited assets.

Another important aspect of yield farming is the concept of impermanent loss, which occurs when the value of the deposited assets changes relative to the other assets in the liquidity pool. This can result in a loss compared to simply holding the assets, but the rewards from yield farming can offset this loss over time.

Yield farmers also need to consider the risks associated with smart contract vulnerabilities, market volatility, and the overall health of the DeFi ecosystem. It is essential to conduct thorough research and due diligence before participating in yield farming to minimize these risks and maximize potential returns.

Overall, yield farming is a dynamic and evolving space within the cryptocurrency industry that offers opportunities for users to earn passive income through active participation in DeFi protocols. By understanding the mechanics behind yield farming and staying informed about the latest trends and developments, users can make informed decisions to optimize their returns while managing risks effectively.

Maximizing returns through Yield Farming strategies

Yield farming strategies are essential for maximizing returns in the decentralized finance (DeFi) space. By utilizing various DeFi protocols and platforms, investors can earn high yields on their cryptocurrency holdings. One popular strategy is to provide liquidity to decentralized exchanges (DEXs) by depositing assets into liquidity pools. In return, investors receive rewards in the form of trading fees and governance tokens.

Another common yield farming strategy involves staking tokens in liquidity pools or yield farming protocols to earn additional tokens as rewards. These rewards can then be reinvested to compound returns over time. It is important for investors to carefully research and analyze different yield farming opportunities to determine the best strategies for maximizing returns while minimizing risks.

Furthermore, yield farming can also involve leveraging different DeFi protocols to borrow assets at low-interest rates and reinvest them in high-yield opportunities. This strategy, known as leverage yield farming, can amplify returns but also comes with increased risks. It is crucial for investors to understand the risks involved in leverage yield farming and to use proper risk management techniques to protect their investments.

Overall, yield farming offers a unique opportunity for investors to earn passive income on their cryptocurrency holdings. By utilizing various strategies and protocols, investors can maximize their returns in the rapidly evolving DeFi ecosystem. However, it is important to conduct thorough research, stay informed about market trends, and exercise caution when participating in yield farming to ensure a successful and profitable investment experience.

The risks and rewards of participating in Yield Farming

Participating in Yield Farming can be a lucrative opportunity for investors looking to maximize their returns in the DeFi space. However, it is important to understand the risks and rewards associated with this strategy before diving in.

One of the main risks of Yield Farming is the potential for smart contract vulnerabilities. Since Yield Farming involves interacting with various DeFi protocols, there is always a risk that a smart contract could be exploited, leading to losses for investors.

Another risk to consider is the impermanent loss that can occur when providing liquidity to a DeFi pool. This loss happens when the price of the assets in the pool changes, resulting in a reduction in the overall value of the investment.

On the other hand, the rewards of Yield Farming can be substantial. By staking cryptocurrencies in DeFi protocols, investors can earn high interest rates and rewards in the form of additional tokens.

Additionally, Yield Farming allows investors to participate in governance decisions for DeFi projects, giving them a say in the future development of the platform.

In conclusion, while Yield Farming can be a profitable strategy for investors, it is essential to carefully weigh the risks and rewards before getting involved. By staying informed and diversifying investments, investors can make the most of this exciting opportunity in the DeFi space.

Comparing traditional investing with Yield Farming

When comparing traditional investing with Yield Farming, it is important to understand the key differences between the two approaches. Traditional investing typically involves buying and holding assets such as stocks, bonds, or real estate with the expectation of generating a return over time. Investors in traditional markets rely on the performance of these assets and the broader market conditions to make a profit.

Yield Farming, on the other hand, is a relatively new concept that has gained popularity in the decentralized finance (DeFi) space. It involves providing liquidity to decentralized exchanges and other platforms in exchange for rewards in the form of interest or tokens. Yield farmers can earn a higher return compared to traditional investments, but it also comes with higher risks due to the volatility of the crypto market.

One of the key differences between traditional investing and Yield Farming is the level of control that investors have over their investments. In traditional markets, investors typically have limited control over how their assets are used, while in DeFi, yield farmers have more flexibility in choosing where to allocate their funds.

Another difference is the potential for higher returns in Yield Farming compared to traditional investments. While traditional markets offer more stability, DeFi platforms can provide significantly higher yields, especially during periods of high market activity. However, it is important to note that these higher returns come with increased risks, including smart contract vulnerabilities and impermanent loss.

Key factors to consider before diving into Yield Farming

Before jumping into Yield Farming, there are several key factors to consider to ensure a successful and profitable experience. It is essential to carefully evaluate these aspects to minimize risks and maximize potential returns.

- Understand the Risks: Yield Farming involves locking up assets in decentralized finance (DeFi) protocols, which can be subject to smart contract bugs, impermanent loss, and other vulnerabilities. It is crucial to be aware of these risks before participating.

- Research Projects: Before investing in any Yield Farming project, conduct thorough research on the protocol, team, and community behind it. Look for audits, reviews, and user feedback to gauge the project’s credibility.

- Consider Liquidity: Liquidity is a key factor in Yield Farming, as it determines the potential rewards you can earn. Make sure to provide sufficient liquidity to the pool you are farming to optimize your returns.

- Monitor APY: Annual Percentage Yield (APY) is a crucial metric in Yield Farming, as it indicates the potential returns you can earn on your investment. Compare APY rates across different platforms to find the most lucrative opportunities.

- Diversify Investments: To mitigate risks, consider diversifying your Yield Farming investments across multiple projects and platforms. This can help spread out potential losses and maximize overall returns.

By carefully considering these key factors before diving into Yield Farming, you can set yourself up for a successful and rewarding experience in the world of decentralized finance.