The Impact of Halving Events on Bitcoin Price

- The History of Bitcoin Halving Events

- Understanding the Mechanism Behind Bitcoin Halving

- Impact of Halving Events on Bitcoin Mining

- Analyzing the Price Trends Before and After Halving Events

- The Role of Market Sentiment in Bitcoin Price Volatility Post-Halving

- Strategies for Investors to Navigate Bitcoin Halving Events

The History of Bitcoin Halving Events

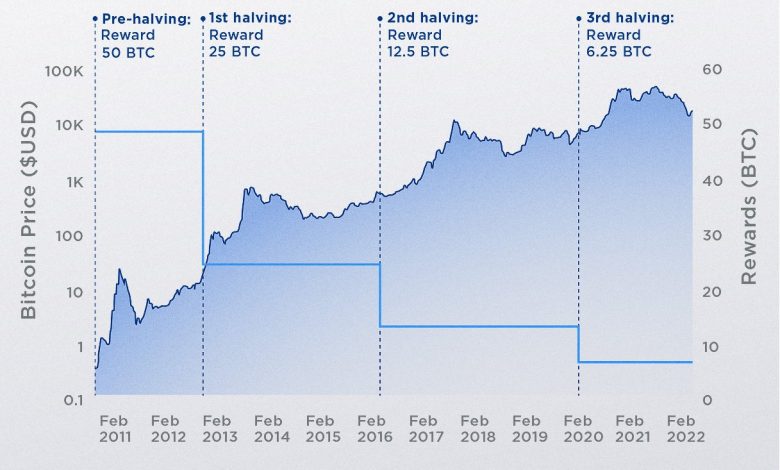

Bitcoin halving events are significant occurrences in the history of the cryptocurrency. These events, which take place approximately every four years, result in the reduction of the reward that miners receive for validating transactions on the Bitcoin network. The first Bitcoin halving event occurred in November 2012, followed by subsequent halvings in July 2016 and May 2020.

During each halving event, the reward for miners is cut in half, leading to a decrease in the rate at which new Bitcoins are created. This reduction in the supply of new Bitcoins entering the market has a direct impact on the overall supply and demand dynamics of the cryptocurrency. As a result, Bitcoin halving events are often associated with an increase in the price of Bitcoin.

Historically, Bitcoin prices have experienced significant gains in the months leading up to and following a halving event. This trend is attributed to the anticipation of reduced supply and increased scarcity of Bitcoin. Investors and traders alike closely monitor halving events as they are seen as potential catalysts for price appreciation.

The impact of Bitcoin halving events on the price of the cryptocurrency is a topic of much debate and speculation within the crypto community. Some analysts believe that the halving events are already priced into the market, while others argue that they have a significant impact on the price of Bitcoin. Regardless of the differing opinions, it is clear that Bitcoin halving events play a crucial role in shaping the price dynamics of the cryptocurrency.

Understanding the Mechanism Behind Bitcoin Halving

Bitcoin halving is a significant event in the cryptocurrency world that occurs approximately every four years. This event is programmed into the Bitcoin protocol and involves cutting the rewards miners receive for validating transactions in half. The purpose of this mechanism is to control the supply of Bitcoin and prevent inflation.

During a Bitcoin halving event, the number of new Bitcoins created with each mined block is reduced by 50%. This reduction in supply has a direct impact on the overall supply of Bitcoin in circulation. As a result, the scarcity of Bitcoin increases, which can potentially drive up its price due to the basic economic principle of supply and demand.

The mechanism behind Bitcoin halving is designed to mimic the scarcity of precious metals like gold. By reducing the rate at which new Bitcoins are introduced into the market, Bitcoin becomes more scarce over time. This scarcity is one of the key factors that contribute to the value of Bitcoin and its price appreciation over the years.

Investors and traders closely monitor Bitcoin halving events as they have historically been associated with significant price increases. The anticipation of reduced supply and increased scarcity often leads to a surge in demand for Bitcoin leading up to the halving event. This increased demand, coupled with the reduced supply, can create a bullish market sentiment and drive up the price of Bitcoin.

In conclusion, understanding the mechanism behind Bitcoin halving is crucial for investors and traders looking to capitalize on the potential price movements associated with this event. By recognizing the impact of reduced supply and increased scarcity on the value of Bitcoin, market participants can make informed decisions to navigate the volatile cryptocurrency market effectively.

Impact of Halving Events on Bitcoin Mining

Halving events in Bitcoin mining have a significant impact on the overall ecosystem. When a halving event occurs, the rewards for miners are cut in half, leading to a decrease in the supply of new Bitcoins entering the market. This reduction in supply can create scarcity, driving up the price of Bitcoin due to increased demand.

Miners may also feel the effects of halving events as their profitability decreases. With fewer rewards for each block mined, miners must either increase their operational efficiency or face reduced profits. Some miners may be forced to shut down their operations altogether if they are unable to cover their costs.

Despite the challenges that halving events pose for miners, they are an essential part of Bitcoin’s design. By reducing the rate at which new Bitcoins are created, halving events help to control inflation and ensure the long-term sustainability of the cryptocurrency. This mechanism also helps to maintain the value of existing Bitcoins, making them more attractive to investors.

Analyzing the Price Trends Before and After Halving Events

Bitcoin price trends before and after halving events provide valuable insights into the impact of these occurrences on the cryptocurrency market. By analyzing historical data, we can observe patterns that shed light on how halving events influence the price of Bitcoin.

**Before Halving Events:**

– **Price Surge:** Prior to halving events, Bitcoin often experiences a surge in price as investors anticipate the reduction in the rate of new supply entering the market. This heightened demand can drive up prices leading up to the event.

– **Market Speculation:** Traders may engage in speculative behavior, trying to capitalize on the expected price increase post-halving. This can create volatility in the market as buying and selling activity intensifies.

**After Halving Events:**

– **Price Correction:** Following halving events, Bitcoin prices may experience a correction as the initial hype subsides. This correction can be a natural response to the market adjusting to the new supply dynamics.

– **Long-Term Growth:** Despite short-term fluctuations, halving events have historically been followed by periods of sustained growth in Bitcoin prices. This long-term trend underscores the significance of halving events in shaping the value of Bitcoin.

Analyzing price trends before and after halving events can provide valuable insights for investors looking to understand the dynamics of the cryptocurrency market. By studying historical patterns and market behavior, traders can make more informed decisions about their investment strategies in relation to halving events.

The Role of Market Sentiment in Bitcoin Price Volatility Post-Halving

Market sentiment plays a crucial role in determining the volatility of Bitcoin prices post-halving events. The emotions and attitudes of traders and investors towards the cryptocurrency can have a significant impact on its price movements. Positive sentiment can drive up prices as more people are willing to buy, while negative sentiment can lead to selling pressure and price declines.

After a halving event, market sentiment is often influenced by factors such as media coverage, regulatory developments, macroeconomic trends, and overall market conditions. Positive news and developments can create a bullish sentiment, leading to increased demand for Bitcoin and higher prices. Conversely, negative news can trigger a bearish sentiment, causing prices to fall as investors look to sell their holdings.

It is essential for traders and investors to monitor market sentiment closely, as it can provide valuable insights into potential price movements. By understanding the prevailing sentiment and its impact on Bitcoin prices, market participants can make more informed decisions and better navigate the post-halving volatility.

Strategies for Investors to Navigate Bitcoin Halving Events

Investors can employ various strategies to navigate **Bitcoin halving events** successfully. One approach is to **diversify** their **investment** portfolio to reduce **risk** exposure. By spreading their **funds** across different **assets**, investors can mitigate the impact of **price** fluctuations associated with **halving events**. Additionally, staying informed about market trends and **fundamental** analysis can help investors make **informed** decisions during **volatile** periods.

Another **strategy** is to **hodl** (hold on for dear life) **Bitcoin** through **halving events**. **Hodling** involves **holding** onto **Bitcoin** for the long term, regardless of **short-term** **price** fluctuations. This **strategy** is based on the belief that **Bitcoin** will continue to increase in **value** over time, despite **temporary** setbacks. **Hodling** can be a **effective** way to **capitalize** on the **long-term** **growth** potential of **Bitcoin**.

Furthermore, investors can consider **trading** **Bitcoin** derivatives, such as **futures** and **options**, to **hedge** their **positions** during **halving events**. **Derivatives** allow investors to **speculate** on the **price** of **Bitcoin** without **owning** the underlying **asset**. This can be a **useful** **strategy** for **investors** looking to **manage** **risk** and **take advantage** of **price** **volatility** during **halving events**.

In conclusion, **Bitcoin halving events** can have a significant impact on the **price** of **Bitcoin**, presenting both **opportunities** and **challenges** for **investors**. By **diversifying** their **portfolio**, **hodling** **Bitcoin**, and **trading** **derivatives**, investors can navigate **halving events** successfully and **position** themselves for **long-term** **growth** in the **cryptocurrency** market.