The Benefits and Risks of Yield Farming

- Understanding Yield Farming in DeFi

- Maximizing Returns: How Yield Farming Works

- The Risks of Impermanent Loss in Yield Farming

- Comparing Yield Farming Strategies: APY vs. APR

- Yield Farming Platforms: A Comprehensive Overview

- Regulatory Challenges and Future Outlook for Yield Farming

Understanding Yield Farming in DeFi

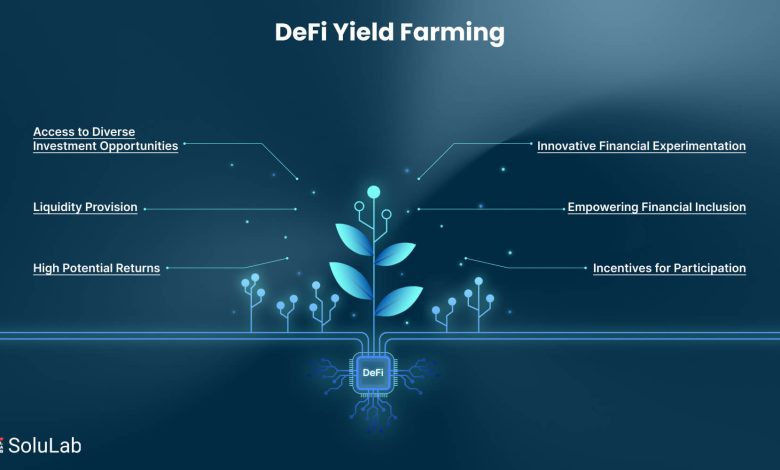

Understanding yield farming in DeFi can be a complex concept for those new to the world of cryptocurrency. In simple terms, yield farming refers to the process of earning a return on crypto assets by providing them to liquidity pools or other DeFi protocols. This is done in exchange for rewards in the form of additional tokens or fees.

Yield farming has gained popularity due to the potential for high returns compared to traditional investment options. However, it is important to understand the risks involved. One of the main risks is impermanent loss, which occurs when the value of the assets you provide to a liquidity pool changes relative to each other.

Another risk to consider is the smart contract risks associated with DeFi platforms. These risks include bugs in the code that could lead to loss of funds. It is crucial to do thorough research and due diligence before participating in any yield farming opportunities.

Maximizing Returns: How Yield Farming Works

Yield farming is a strategy used in decentralized finance (DeFi) to maximize returns on cryptocurrency holdings. It involves lending or staking crypto assets in exchange for rewards, typically in the form of additional tokens. This process allows investors to earn passive income on their investments by leveraging various DeFi protocols.

Yield farming works by users providing liquidity to decentralized exchanges or lending platforms. In return, they receive rewards in the form of interest, trading fees, or governance tokens. These rewards can then be reinvested to compound returns, further increasing the overall yield on the initial investment.

One of the key benefits of yield farming is the potential for high returns compared to traditional savings accounts or investment vehicles. By actively participating in DeFi protocols, investors can take advantage of opportunities to earn additional income on their crypto holdings.

However, it’s important to note that yield farming also comes with risks. The decentralized nature of DeFi platforms can expose investors to smart contract vulnerabilities, impermanent loss, and market volatility. It’s crucial for participants to conduct thorough research and due diligence before engaging in yield farming to mitigate these risks.

The Risks of Impermanent Loss in Yield Farming

One of the main risks associated with yield farming is impermanent loss. Impermanent loss occurs when the value of the assets you have provided as liquidity changes compared to when you initially deposited them. This can happen when the price of one of the assets in the liquidity pool fluctuates significantly. As a result, you may end up with fewer assets overall than if you had simply held onto them without providing liquidity.

Impermanent loss can be particularly problematic in volatile markets where prices can change rapidly. It is important to carefully consider the potential for impermanent loss before participating in yield farming. While impermanent loss is not always avoidable, there are strategies you can use to mitigate its impact, such as choosing liquidity pools with lower volatility assets or using impermanent loss protection protocols.

Comparing Yield Farming Strategies: APY vs. APR

When comparing different yield farming strategies, it is essential to understand the difference between Annual Percentage Yield (APY) and Annual Percentage Rate (APR). APY takes into account the effect of compounding on the interest earned, making it a more accurate measure of the overall return on investment. On the other hand, APR does not consider compounding, providing a simpler but potentially misleading view of the yield.

Investors should carefully consider whether they prefer to focus on APY or APR when evaluating yield farming opportunities. While APY may provide a more comprehensive picture of potential returns, APR can still be a useful metric for comparing different strategies. Ultimately, the choice between APY and APR will depend on the individual investor’s preferences and risk tolerance.

In conclusion, understanding the difference between APY and APR is crucial for making informed decisions in yield farming. By considering both metrics and their implications, investors can better assess the potential benefits and risks of different strategies. Whether prioritizing the compounding effect captured by APY or the simplicity of APR, investors can make more strategic choices to optimize their yield farming returns.

Yield Farming Platforms: A Comprehensive Overview

Yield farming platforms have gained significant popularity in the decentralized finance (DeFi) space. These platforms allow users to earn passive income by providing liquidity to various protocols. By staking their crypto assets, users can participate in different farming pools and receive rewards in the form of additional tokens.

One of the key benefits of yield farming platforms is the potential for high returns on investment. Users can earn a substantial yield on their crypto assets by participating in farming activities. Additionally, yield farming allows users to diversify their investment portfolio and explore new opportunities in the DeFi ecosystem.

However, it is essential to note that yield farming also comes with certain risks. The most significant risk is impermanent loss, which occurs when the value of the assets in a liquidity pool fluctuates. Users may also be exposed to smart contract risks, such as bugs or vulnerabilities that could result in financial losses.

Overall, yield farming platforms offer an exciting opportunity for users to earn passive income in the DeFi space. By carefully evaluating the risks and rewards associated with these platforms, users can make informed decisions about their investment strategies. It is crucial to conduct thorough research and due diligence before participating in any yield farming activities to mitigate potential risks and maximize returns.

Regulatory Challenges and Future Outlook for Yield Farming

When it comes to yield farming, there are several regulatory challenges that need to be addressed. As this practice involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards, it raises questions about the legal and compliance aspects of these transactions. Regulators around the world are still trying to catch up with the rapid growth of the DeFi space, which means that uncertainty surrounds the regulatory framework for yield farming.

One of the main concerns is the potential for money laundering and fraud in yield farming activities. Without proper oversight and regulation, bad actors could take advantage of the anonymity and decentralized nature of DeFi platforms to engage in illicit activities. This could lead to reputational damage for the entire DeFi industry and increased scrutiny from regulators.

Looking ahead, the future outlook for yield farming will depend on how regulators decide to address these challenges. It is likely that we will see more regulations being introduced to protect investors and ensure the integrity of the DeFi ecosystem. This could mean additional compliance requirements for participants in yield farming, as well as greater transparency and reporting obligations.