How to Transfer Funds Between Exchanges

- Understanding the Basics of Transferring Funds Between Exchanges

- Step-by-Step Guide to Transferring Funds Safely and Efficiently

- Common Mistakes to Avoid When Transferring Funds Between Exchanges

- Tips for Minimizing Fees When Moving Funds Between Exchanges

- Exploring Different Methods for Transferring Funds Between Exchanges

- Ensuring Security: Best Practices for Transferring Funds Between Exchanges

Understanding the Basics of Transferring Funds Between Exchanges

Transferring funds between exchanges is a common practice among cryptocurrency traders. It allows them to take advantage of price differences and maximize their profits. However, it is essential to understand the basics of this process to ensure a smooth and successful transfer.

When transferring funds between exchanges, the first step is to log in to your account on the exchange where you currently hold the funds. Once you are logged in, look for the option to withdraw or transfer funds. This option is usually located in the “Wallet” or “Funds” section of the exchange’s website.

Next, you will need to select the cryptocurrency you want to transfer and enter the amount you wish to send. It is crucial to double-check the recipient address before confirming the transfer to avoid any mistakes. Once you have entered all the necessary information, you can proceed with the transfer.

After initiating the transfer from the sending exchange, you will need to wait for the transaction to be confirmed on the blockchain. This process can take anywhere from a few minutes to several hours, depending on the network congestion and the cryptocurrency you are transferring.

Once the transaction is confirmed, the funds will be deducted from your account on the sending exchange and credited to your account on the receiving exchange. You can then use these funds to trade or invest in other cryptocurrencies as you see fit.

In conclusion, transferring funds between exchanges is a straightforward process that requires attention to detail and careful execution. By following the steps outlined above, you can ensure that your funds are transferred securely and efficiently, allowing you to take full advantage of the opportunities presented by different exchanges.

Step-by-Step Guide to Transferring Funds Safely and Efficiently

When transferring funds between exchanges, it is crucial to do so safely and efficiently to avoid any potential risks or delays. Follow this step-by-step guide to ensure a smooth transfer process:

- Verify Your Accounts: Before initiating any transfer, make sure that your accounts on both exchanges are verified and in good standing. This will help prevent any issues during the transfer.

- Choose the Right Cryptocurrency: Select the appropriate cryptocurrency for the transfer based on the exchanges’ supported currencies and fees. Consider using a stablecoin to minimize price volatility.

- Generate a Deposit Address: Obtain a deposit address from the receiving exchange for the selected cryptocurrency. Double-check the address to avoid any errors.

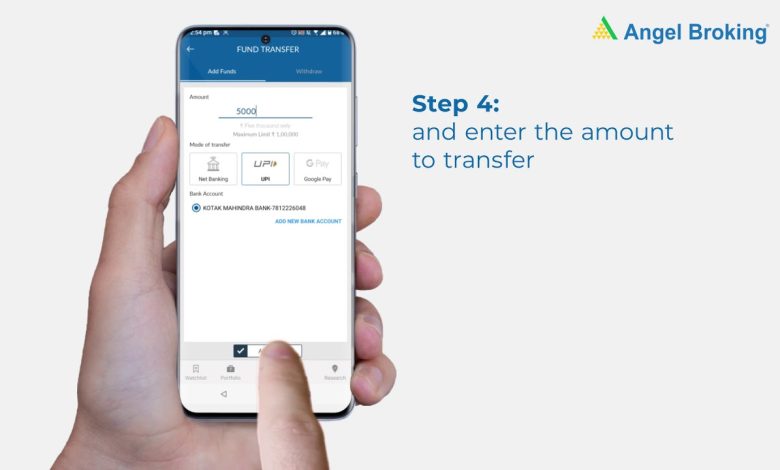

- Initiate the Transfer: Go to the sending exchange and initiate the transfer using the deposit address obtained from the receiving exchange. Enter the amount to transfer and confirm the transaction.

- Monitor the Transfer: Keep an eye on the transfer status to ensure that the funds are successfully sent and received. This will help you address any issues promptly.

- Confirm Receipt: Once the transfer is complete, verify that the funds have been successfully deposited into your account on the receiving exchange. You can then proceed with trading or other activities.

By following these steps, you can transfer funds between exchanges securely and efficiently, minimizing the risk of errors or delays. Remember to always double-check your transactions and keep track of your funds throughout the process.

Common Mistakes to Avoid When Transferring Funds Between Exchanges

When transferring funds between exchanges, there are several common mistakes that you should avoid to ensure a smooth and successful transaction. By being aware of these pitfalls, you can help protect your funds and prevent any unnecessary delays or complications.

- One common mistake to avoid is entering the wrong wallet address. It is crucial to double-check the recipient’s wallet address before initiating the transfer to prevent sending funds to the wrong destination.

- Another mistake to watch out for is not considering the network fees. Different exchanges may have varying fees for transferring funds, so make sure to factor this into your calculations to avoid any surprises.

- It is also important to be mindful of the transfer limits on each exchange. Exceeding these limits could result in your transaction being rejected or delayed, so be sure to stay within the specified boundaries.

- Additionally, failing to enable two-factor authentication (2FA) on both exchanges can leave your funds vulnerable to security breaches. By adding an extra layer of protection, you can help safeguard your assets during the transfer process.

- Lastly, not keeping track of your transfer history can lead to confusion or difficulty in resolving any issues that may arise. Be sure to maintain detailed records of your transactions to help streamline the process and address any concerns promptly.

By avoiding these common mistakes when transferring funds between exchanges, you can help ensure a seamless and secure experience. Taking the time to double-check important details, consider fees and limits, prioritize security measures, and maintain accurate records can go a long way in safeguarding your assets during the transfer process.

Tips for Minimizing Fees When Moving Funds Between Exchanges

When transferring funds between exchanges, it is important to be mindful of the fees involved in the process. Here are some tips to help minimize fees and maximize your returns:

- Compare fees: Before initiating any transfer, take the time to compare the fees charged by different exchanges. Look for exchanges that offer competitive rates to ensure you are not overpaying for the transfer.

- Consolidate funds: Instead of making multiple small transfers, consider consolidating your funds and transferring them in larger amounts. This can help reduce the overall fees you incur during the process.

- Use stablecoins: Consider using stablecoins like USDT or USDC for transferring funds between exchanges. These coins are pegged to the value of a fiat currency, which can help minimize price fluctuations and reduce transaction fees.

- Take advantage of promotions: Keep an eye out for any promotions or discounts offered by exchanges for fund transfers. Taking advantage of these offers can help lower your overall costs.

- Avoid peak times: Try to avoid transferring funds during peak trading hours, as this can lead to higher fees due to increased network congestion. Opt for off-peak times to save on transaction costs.

By following these tips, you can minimize the fees associated with transferring funds between exchanges and ensure that you retain more of your hard-earned money.

Exploring Different Methods for Transferring Funds Between Exchanges

Transferring funds between exchanges can be done using various methods, each with its own advantages and disadvantages. One common method is to use cryptocurrency as an intermediary. This involves depositing cryptocurrency into one exchange, selling it for a stablecoin like USDT, and then withdrawing the stablecoin to the other exchange. Another method is to use bank transfers, where you link your bank account to both exchanges and transfer funds directly. However, this method can be slower and may involve higher fees compared to using cryptocurrency.

Some exchanges also offer the option to transfer funds between them directly, without the need for an intermediary. This can be a convenient option if both exchanges support this feature. Additionally, some exchanges offer the option to use third-party payment processors like PayPal or Skrill to transfer funds between exchanges. While this can be a convenient option, it may involve higher fees compared to other methods.

It is important to consider factors such as fees, processing times, and security when choosing a method to transfer funds between exchanges. Additionally, it is recommended to double-check the details of the transfer, such as the recipient address, before initiating the transfer to avoid any potential errors. By exploring different methods for transferring funds between exchanges, you can choose the option that best suits your needs and preferences.

Ensuring Security: Best Practices for Transferring Funds Between Exchanges

When transferring funds between exchanges, it is crucial to prioritize security to protect your assets. Follow these best practices to ensure a safe transfer:

- Enable two-factor authentication (2FA) on both exchanges to add an extra layer of security to your accounts.

- Verify the withdrawal address multiple times before initiating the transfer to prevent sending funds to the wrong destination.

- Avoid using public Wi-Fi networks when transferring funds, as they may not be secure and could expose your sensitive information.

- Consider using a hardware wallet to store your funds offline and reduce the risk of hacking or theft.

- Regularly monitor your accounts for any suspicious activity and report any unauthorized transactions immediately.

By following these best practices, you can transfer funds between exchanges securely and minimize the risk of potential security threats. Remember to always prioritize security when managing your cryptocurrency assets.