The Role of Decentralized Finance (DeFi) in Crypto

- Understanding the Basics of Decentralized Finance (DeFi)

- Exploring the Benefits of DeFi in the Crypto Ecosystem

- The Rise of DeFi Platforms and Their Impact on Traditional Finance

- Challenges and Risks Associated with DeFi Investments

- Regulatory Considerations for Decentralized Finance

- The Future of DeFi: Trends and Innovations to Watch

Understanding the Basics of Decentralized Finance (DeFi)

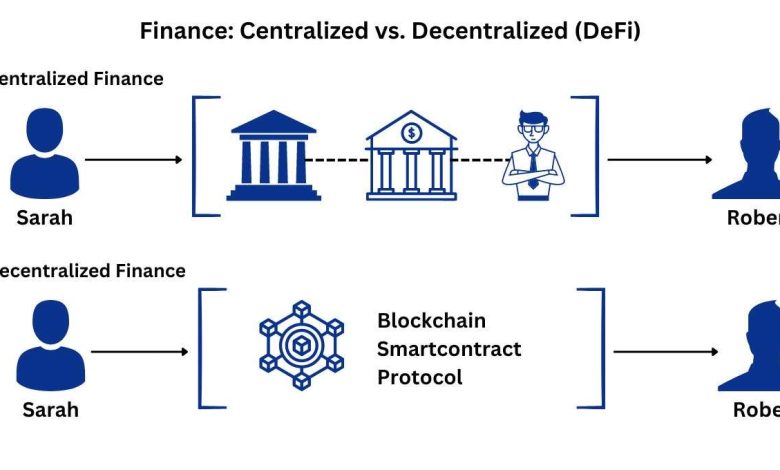

Decentralized Finance (DeFi) is a rapidly growing sector within the cryptocurrency industry that aims to revolutionize traditional financial systems by leveraging blockchain technology. In essence, DeFi refers to the use of decentralized networks and smart contracts to provide financial services without the need for intermediaries such as banks or brokers.

One of the key principles of DeFi is the concept of decentralization, which means that financial transactions and services are conducted on a peer-to-peer basis, eliminating the need for centralized authorities. This not only reduces the costs associated with traditional financial services but also increases transparency and security.

Some of the most popular applications of DeFi include decentralized exchanges (DEXs), lending platforms, and stablecoins. DEXs allow users to trade cryptocurrencies directly with one another without the need for a centralized exchange, while lending platforms enable users to borrow and lend digital assets through smart contracts.

Stablecoins, on the other hand, are cryptocurrencies that are pegged to a stable asset such as the US dollar, providing users with a more stable store of value compared to volatile cryptocurrencies like Bitcoin. These applications are just a few examples of how DeFi is reshaping the financial landscape and offering new opportunities for users to participate in the global economy.

Exploring the Benefits of DeFi in the Crypto Ecosystem

Decentralized Finance (DeFi) has been gaining significant traction in the crypto ecosystem due to its numerous benefits and advantages. DeFi offers a wide range of opportunities for users to access financial services in a decentralized manner, without the need for traditional intermediaries such as banks or financial institutions.

One of the key benefits of DeFi is its ability to provide users with greater control over their assets and financial transactions. By utilizing smart contracts on blockchain networks, users can securely manage their funds and execute transactions without relying on third parties. This level of autonomy and transparency is a major draw for many individuals looking to participate in the crypto space.

Furthermore, DeFi platforms offer users the opportunity to earn passive income through various mechanisms such as staking, lending, and liquidity provision. These decentralized protocols enable users to put their assets to work and generate returns, all while maintaining control of their funds. This has opened up new avenues for individuals to grow their wealth in a decentralized and permissionless manner.

Another significant benefit of DeFi is its global accessibility. Traditional financial systems are often limited by geographical boundaries and regulatory constraints, making it difficult for individuals in certain regions to access basic financial services. DeFi, on the other hand, is open to anyone with an internet connection, allowing users from around the world to participate in the ecosystem and benefit from its services.

In conclusion, the rise of DeFi in the crypto ecosystem has brought about a paradigm shift in the way financial services are accessed and utilized. With its emphasis on decentralization, autonomy, and accessibility, DeFi is poised to revolutionize the traditional financial system and empower individuals to take control of their financial future.

The Rise of DeFi Platforms and Their Impact on Traditional Finance

The rise of decentralized finance (DeFi) platforms has had a significant impact on traditional finance systems. These platforms leverage blockchain technology to provide financial services without the need for intermediaries such as banks or brokers. This has led to a democratization of finance, allowing individuals to access a wide range of financial products and services directly from their digital wallets.

One of the key advantages of DeFi platforms is their ability to offer users greater control over their assets. By using smart contracts, users can securely manage their funds and execute transactions without relying on a third party. This has the potential to reduce the risk of fraud and increase transparency in financial transactions.

Furthermore, DeFi platforms are known for their high levels of interoperability, allowing users to easily move assets between different platforms and applications. This has created a vibrant ecosystem of decentralized applications (dApps) that offer a wide range of financial services, including lending, borrowing, trading, and more.

As DeFi platforms continue to gain popularity, they are starting to disrupt traditional financial institutions. Banks and other financial intermediaries are now facing competition from these decentralized platforms, which offer lower fees, faster transactions, and greater accessibility. This has forced traditional finance to adapt and innovate in order to stay competitive in the rapidly changing financial landscape.

Challenges and Risks Associated with DeFi Investments

Investing in DeFi projects can offer lucrative opportunities for investors looking to diversify their portfolios and capitalize on the growing trend of decentralized finance. However, it is essential to be aware of the challenges and risks associated with DeFi investments to make informed decisions and mitigate potential losses.

One of the primary challenges of DeFi investments is the **volatility** of the cryptocurrency market. Prices can fluctuate significantly in a short period, leading to substantial gains or losses for investors. This **price volatility** can be exacerbated by factors such as market speculation, regulatory changes, and technological vulnerabilities.

Another risk associated with DeFi investments is the **security** of decentralized platforms. While blockchain technology is known for its **security** features, DeFi protocols are not immune to hacks and exploits. Smart contract bugs, **phishing** attacks, and **rug pulls** are some of the common **security** vulnerabilities that can result in the loss of funds for investors.

Moreover, the **lack of regulation** in the DeFi space poses a **risk** for investors. Unlike traditional financial markets, DeFi platforms operate without oversight from regulatory authorities, making it challenging to address fraudulent activities, **market manipulation**, and **compliance** issues. This **regulatory uncertainty** can expose investors to legal and financial **risks**.

Additionally, the **complexity** of DeFi protocols can be a barrier for new investors. Understanding how decentralized platforms work, navigating different **yield farming** strategies, and managing multiple **wallets** can be overwhelming for individuals with limited experience in the crypto space. This **complexity** can increase the likelihood of making **mistakes** that could result in financial losses.

In conclusion, while DeFi investments offer exciting opportunities for investors, it is crucial to approach them with caution and **due diligence**. By being aware of the challenges and risks associated with DeFi projects, investors can make informed decisions to protect their capital and maximize their returns in the rapidly evolving world of decentralized finance.

Regulatory Considerations for Decentralized Finance

When it comes to decentralized finance (DeFi), there are several regulatory considerations that need to be taken into account. While DeFi offers a new way of conducting financial transactions without the need for traditional intermediaries, it also raises concerns about compliance and oversight. Here are some key regulatory considerations for DeFi:

- Compliance: Ensuring compliance with existing financial regulations is crucial for the long-term success of DeFi projects. Developers and users need to be aware of the legal requirements in their jurisdiction and take steps to adhere to them.

- Security: Security is a major concern in the DeFi space, as hacks and vulnerabilities can lead to significant financial losses. Implementing robust security measures and conducting regular audits can help mitigate these risks.

- Privacy: DeFi platforms often involve the transfer of sensitive financial information, raising concerns about user privacy. Developers should prioritize data protection and implement measures to safeguard user data.

- Smart Contract Risks: Smart contracts are at the core of many DeFi applications, but they are not immune to bugs and vulnerabilities. Thoroughly testing smart contracts and implementing fail-safe mechanisms are essential to minimize risks.

- Regulatory Clarity: The regulatory landscape for DeFi is still evolving, with different jurisdictions taking varying approaches to oversight. Clear guidelines and regulatory frameworks can provide much-needed clarity for developers and users.

Overall, navigating the regulatory landscape is a key challenge for the DeFi industry. By staying informed about regulatory developments, implementing best practices for compliance and security, and prioritizing user privacy, DeFi projects can build trust and credibility in the market.

The Future of DeFi: Trends and Innovations to Watch

The future of decentralized finance (DeFi) is filled with exciting trends and innovations that are shaping the landscape of the crypto industry. As the popularity of DeFi continues to grow, it is important to stay informed about the latest developments in this space. Here are some key trends and innovations to watch out for:

- 1. **Interoperability**: One of the most significant trends in DeFi is the push for interoperability between different blockchain networks. This will allow for seamless communication and transactions between various DeFi platforms, ultimately enhancing the overall user experience.

- 2. **Scalability Solutions**: Scalability has been a major challenge for DeFi platforms, leading to high gas fees and slow transaction times. Innovations such as layer 2 solutions and sharding are being developed to address these issues and improve the efficiency of DeFi protocols.

- 3. **Security Enhancements**: With the rise of hacks and exploits in the DeFi space, there is a growing focus on enhancing security measures. New protocols and technologies are being introduced to mitigate risks and protect user funds from potential threats.

- 4. **Regulatory Compliance**: As DeFi continues to gain mainstream adoption, regulatory compliance is becoming a key area of focus. Projects are working towards ensuring compliance with existing regulations to avoid legal issues and promote a more sustainable ecosystem.

- 5. **Decentralized Autonomous Organizations (DAOs)**: DAOs are gaining traction in the DeFi space, allowing for decentralized governance and decision-making processes. These organizations enable community members to have a say in the direction of projects and promote transparency and inclusivity.

By keeping an eye on these trends and innovations, investors and users can stay ahead of the curve and capitalize on the opportunities presented by the evolving DeFi landscape. As the industry continues to mature, it is essential to adapt to these changes and embrace the advancements that will shape the future of decentralized finance.