How to Use Fundamental Analysis for Crypto Investments

- Understanding the basics of fundamental analysis

- Key factors to consider when analyzing a cryptocurrency

- Using financial statements to evaluate a crypto project

- The importance of market trends in fundamental analysis

- Comparing different cryptocurrencies based on fundamental analysis

- Strategies for incorporating fundamental analysis into your investment decisions

Understanding the basics of fundamental analysis

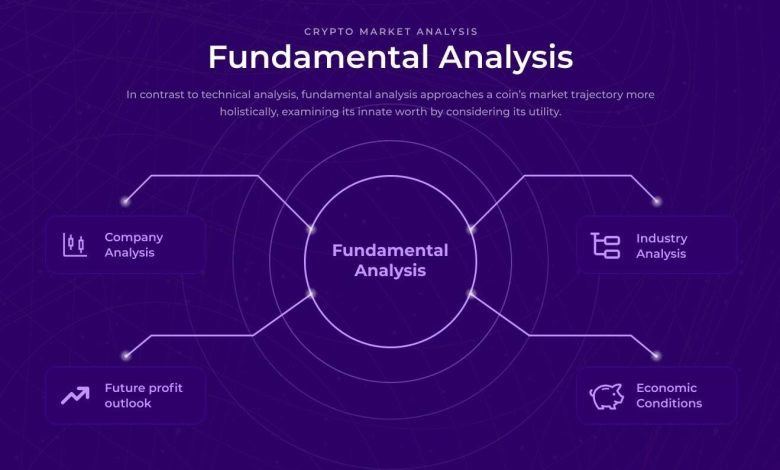

Fundamental analysis is a crucial aspect of making informed decisions when it comes to investing in cryptocurrencies. By understanding the basics of fundamental analysis, investors can gain valuable insights into the underlying factors that drive the value of a particular cryptocurrency.

One of the key components of fundamental analysis is evaluating the financial health of a cryptocurrency project. This involves looking at factors such as the project’s revenue, expenses, and overall profitability. By analyzing these financial metrics, investors can assess the long-term viability of a project and make more informed investment decisions.

Another important aspect of fundamental analysis is evaluating the team behind a cryptocurrency project. The team’s experience, expertise, and track record can have a significant impact on the success of a project. Investors should research the backgrounds of the team members and assess whether they have the skills and knowledge necessary to execute on the project’s goals.

Additionally, fundamental analysis involves evaluating the technology and utility of a cryptocurrency. Investors should assess the technology that underpins a project, as well as its real-world applications and potential for widespread adoption. By understanding the technology and utility of a cryptocurrency, investors can better gauge its long-term potential for growth.

Overall, fundamental analysis is a valuable tool for investors looking to make informed decisions in the cryptocurrency market. By evaluating factors such as financial health, team expertise, and technology utility, investors can gain a deeper understanding of a project’s potential for success and make more strategic investment choices.

Key factors to consider when analyzing a cryptocurrency

When analyzing a cryptocurrency for potential investment, there are several key factors to consider that can help you make an informed decision. One important factor to look at is the technology behind the cryptocurrency. This includes the blockchain technology it uses, as well as any unique features or innovations that set it apart from other cryptocurrencies. Understanding the technology can give you insight into the long-term viability and potential growth of the cryptocurrency.

Another important factor to consider is the team behind the cryptocurrency. A strong and experienced team can be a good indicator of the project’s credibility and ability to execute on its vision. Look for information about the team members’ backgrounds, experience in the industry, and any previous successful projects they have been involved with. This can help you assess the team’s ability to navigate challenges and drive the project forward.

In addition to the technology and team, it’s also important to consider the market demand for the cryptocurrency. Look at factors such as the size of the target market, the problem the cryptocurrency is solving, and any partnerships or collaborations that could help drive adoption. Understanding the market demand can give you insight into the potential for growth and value appreciation of the cryptocurrency.

Furthermore, it’s crucial to analyze the tokenomics of the cryptocurrency. This includes factors such as the total supply of tokens, the distribution of tokens, and any mechanisms in place to incentivize holders and users. Understanding the tokenomics can help you assess the potential for scarcity, demand, and value appreciation of the cryptocurrency.

Overall, by considering these key factors – technology, team, market demand, and tokenomics – you can make a more informed decision when analyzing a cryptocurrency for investment. Taking a comprehensive approach to fundamental analysis can help you identify promising opportunities and mitigate risks in the volatile world of cryptocurrency investments.

Using financial statements to evaluate a crypto project

When evaluating a crypto project for investment, it is essential to analyze the financial statements to gain insights into the project’s financial health and performance. Financial statements provide valuable information about the project’s revenue, expenses, profits, and overall financial position.

One key financial statement to review is the income statement, which shows the project’s revenues and expenses over a specific period. By analyzing the income statement, investors can assess the project’s profitability and growth potential. Additionally, the balance sheet provides a snapshot of the project’s assets, liabilities, and equity at a specific point in time, giving investors a clear picture of the project’s financial position.

Another important financial statement to consider is the cash flow statement, which shows how much cash is generated and used by the project during a specific period. Analyzing the cash flow statement can help investors determine the project’s ability to generate cash and meet its financial obligations.

By carefully reviewing and analyzing the financial statements of a crypto project, investors can make informed decisions about whether to invest in the project. It is crucial to look beyond the project’s token price and market sentiment and delve into the financial fundamentals to assess the project’s long-term viability and potential for growth.

The importance of market trends in fundamental analysis

Understanding market trends is crucial in fundamental analysis for crypto investments. By analyzing market trends, investors can gain valuable insights into the overall direction of the market and make informed decisions about when to buy or sell cryptocurrencies.

Market trends can provide important information about the supply and demand dynamics of a particular cryptocurrency, as well as the broader market sentiment towards digital assets. By staying abreast of market trends, investors can identify potential opportunities for profit and mitigate risks associated with market volatility.

Moreover, market trends can also help investors anticipate potential price movements and identify emerging investment trends in the crypto market. By incorporating market trend analysis into their fundamental analysis strategy, investors can make more informed decisions and improve their overall investment performance.

Comparing different cryptocurrencies based on fundamental analysis

When comparing different cryptocurrencies based on fundamental analysis, it is essential to consider various factors that can impact their value and potential for growth. Some key metrics to evaluate include the team behind the project, the technology and innovation it offers, the market demand for the cryptocurrency, and its overall adoption and use cases.

One important aspect to consider is the team behind the cryptocurrency. A strong and experienced team with a proven track record can significantly increase the likelihood of success for a project. Look for teams with expertise in blockchain technology, finance, and business development.

Another crucial factor to analyze is the technology and innovation that the cryptocurrency offers. Evaluate the underlying technology, such as the consensus mechanism, scalability, and security features. Additionally, consider any unique features or use cases that set the cryptocurrency apart from others in the market.

Market demand is also a critical consideration when comparing cryptocurrencies. Look at factors such as trading volume, liquidity, and market capitalization to gauge the level of interest and investment in a particular cryptocurrency. High demand can indicate strong potential for growth.

Lastly, consider the adoption and real-world use cases of the cryptocurrency. Evaluate whether the cryptocurrency is being used for actual transactions or if it is primarily held as a speculative investment. Cryptocurrencies with practical applications and widespread adoption are more likely to maintain long-term value.

Strategies for incorporating fundamental analysis into your investment decisions

When it comes to incorporating fundamental analysis into your investment decisions for cryptocurrencies, there are several strategies you can utilize to make informed choices. By understanding the underlying factors that drive the value of a particular cryptocurrency, you can better assess its potential for growth and profitability. Here are some key strategies to consider:

- Research the Team: One of the most important aspects of fundamental analysis is researching the team behind the cryptocurrency project. Look into their experience, expertise, and track record to gauge their ability to deliver on their promises.

- Study the Whitepaper: The whitepaper is a crucial document that outlines the technology, purpose, and goals of the cryptocurrency project. Analyzing the whitepaper can give you valuable insights into the viability and potential of the project.

- Assess Market Demand: Understanding the market demand for a particular cryptocurrency is essential for predicting its future value. Look into factors such as user adoption, partnerships, and industry trends to gauge the potential demand for the cryptocurrency.

- Analyze Financials: Examining the financials of a cryptocurrency project can provide valuable information about its sustainability and growth potential. Look into factors such as revenue streams, expenses, and funding sources to assess the financial health of the project.

- Monitor News and Events: Staying informed about the latest news and events in the cryptocurrency space can help you make more informed investment decisions. Keep an eye on regulatory developments, partnerships, and technological advancements that could impact the value of a cryptocurrency.

By incorporating these strategies into your fundamental analysis process, you can make more informed investment decisions and increase your chances of success in the volatile world of cryptocurrency investing.