How to Safely Store Your Cryptocurrencies

- Understanding the Risks of Storing Cryptocurrencies

- Choosing the Right Wallet for Your Cryptocurrencies

- Implementing Two-Factor Authentication for Added Security

- Backing Up Your Wallet: Best Practices to Avoid Losing Your Cryptocurrencies

- Protecting Your Private Keys: The Key to Safeguarding Your Cryptocurrencies

- Offline Storage Options: Cold Wallets and Hardware Wallets Explained

Understanding the Risks of Storing Cryptocurrencies

It is crucial to understand the risks associated with storing cryptocurrencies to ensure the safety of your digital assets. Cryptocurrencies are vulnerable to hacking, theft, and loss if not stored properly. By being aware of these risks, you can take the necessary precautions to protect your investments.

One of the main risks of storing cryptocurrencies is the potential for hacking. Hackers are constantly looking for vulnerabilities in online wallets and exchanges to steal digital currencies. It is essential to use secure wallets and exchanges with robust security measures to minimize the risk of hacking.

Another risk to consider is the possibility of theft. If your private keys are compromised, hackers can easily access your cryptocurrency funds and transfer them to their own wallets. It is important to keep your private keys secure and never share them with anyone to prevent theft.

Additionally, there is a risk of losing access to your cryptocurrencies if you forget your wallet password or lose your recovery phrase. Without this information, you will not be able to access your funds, resulting in permanent loss. It is crucial to store this information in a safe place and make backups to avoid losing access to your digital assets.

By understanding the risks of storing cryptocurrencies and taking the necessary precautions, you can safeguard your investments and have peace of mind knowing that your digital assets are secure. Stay informed and stay safe in the world of cryptocurrency storage.

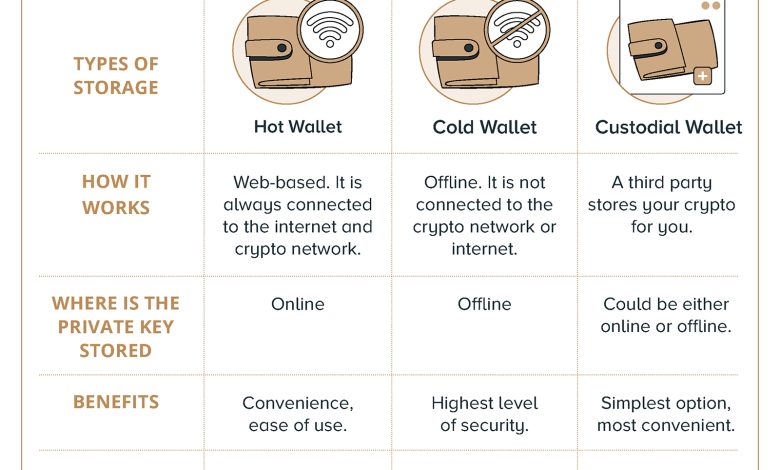

Choosing the Right Wallet for Your Cryptocurrencies

When it comes to storing your cryptocurrencies, choosing the right wallet is crucial. There are several types of wallets available, each with its own set of features and security measures. It’s essential to consider factors such as convenience, security, and ease of use when selecting a wallet for your digital assets.

One option is a hardware wallet, which is a physical device that stores your cryptocurrencies offline. This type of wallet is considered one of the most secure options available, as it is not connected to the internet, making it less vulnerable to hacking attempts. Hardware wallets are also convenient to use, as they allow you to easily access your funds when needed.

Another option is a software wallet, which is a digital wallet that can be accessed through an app or website. Software wallets are convenient for everyday use, as they allow you to easily send and receive cryptocurrencies. However, they are more vulnerable to hacking attempts compared to hardware wallets, as they are connected to the internet.

You can also consider using a paper wallet, which is a physical document that contains your public and private keys. Paper wallets are considered one of the most secure options, as they are not connected to the internet. However, they can be easily lost or damaged, so it’s essential to store them in a safe place.

Ultimately, the right wallet for you will depend on your individual needs and preferences. It’s essential to research different wallet options and choose one that offers the right balance of security and convenience for your cryptocurrency storage needs. By taking the time to select the right wallet, you can help ensure that your digital assets are safe and secure.

Implementing Two-Factor Authentication for Added Security

One effective way to enhance the security of your cryptocurrency storage is by implementing two-factor authentication (2FA). This additional layer of security requires users to provide two different authentication factors before gaining access to their accounts, making it more difficult for unauthorized individuals to breach your account.

When setting up 2FA for your cryptocurrency wallet or exchange account, you typically have the option to choose from different authentication methods, such as SMS codes, email verification, or authenticator apps like Google Authenticator or Authy. It is recommended to use an authenticator app for 2FA as it is considered more secure than SMS or email verification.

By enabling 2FA, you add an extra barrier that significantly reduces the risk of unauthorized access to your cryptocurrency holdings. Even if someone manages to obtain your password, they would still need the second factor (such as a unique code generated by the authenticator app) to successfully log in to your account.

Backing Up Your Wallet: Best Practices to Avoid Losing Your Cryptocurrencies

Backing up your wallet is crucial to ensure the safety of your cryptocurrencies. By following best practices, you can avoid the risk of losing your valuable assets. Here are some tips to help you securely store your cryptocurrencies:

- Use a Hardware Wallet: Consider using a hardware wallet to store your cryptocurrencies offline. This type of wallet provides an extra layer of security by keeping your private keys offline, away from potential hackers.

- Backup Your Wallet: Regularly backup your wallet by storing a copy of your private keys in a secure location. This will allow you to recover your funds in case your wallet is lost or damaged.

- Encrypt Your Wallet: Encrypting your wallet adds an extra layer of security by requiring a password to access your funds. Make sure to use a strong and unique password to protect your cryptocurrencies.

- Enable Two-Factor Authentication: Enable two-factor authentication on your wallet to add an extra layer of security. This will require you to verify your identity using a second method, such as a mobile app or SMS code, before accessing your funds.

- Keep Your Software Updated: Regularly update your wallet software to ensure you have the latest security patches and features. This will help protect your cryptocurrencies from potential vulnerabilities.

By following these best practices, you can securely store your cryptocurrencies and minimize the risk of losing your assets. Remember to always stay informed about the latest security measures and take proactive steps to protect your investments.

Protecting Your Private Keys: The Key to Safeguarding Your Cryptocurrencies

When it comes to safeguarding your cryptocurrencies, protecting your private keys is crucial. Your private keys are essentially the passwords that allow you to access your digital assets. If someone gains access to your private keys, they can easily steal your cryptocurrencies without your knowledge. Therefore, it is essential to take the necessary steps to keep your private keys secure.

One way to protect your private keys is by using a hardware wallet. Hardware wallets are physical devices that store your private keys offline, making them less vulnerable to hacking attempts. By keeping your private keys offline, you can significantly reduce the risk of unauthorized access to your cryptocurrencies.

Another option is to use a paper wallet to store your private keys. A paper wallet is simply a physical document that contains your private keys. By keeping your private keys on a piece of paper, you can ensure that they are not exposed to online threats. However, it is essential to store your paper wallet in a secure location to prevent it from being lost or stolen.

It is also crucial to regularly back up your private keys. By creating multiple copies of your private keys and storing them in different secure locations, you can ensure that you will not lose access to your cryptocurrencies in case of hardware failure or other unforeseen circumstances. Remember to update your backups whenever you make changes to your private keys.

In conclusion, protecting your private keys is the key to safeguarding your cryptocurrencies. By using hardware wallets, paper wallets, and regular backups, you can enhance the security of your digital assets and minimize the risk of unauthorized access. Take the necessary precautions to keep your private keys safe and secure, and enjoy peace of mind knowing that your cryptocurrencies are well-protected.

Offline Storage Options: Cold Wallets and Hardware Wallets Explained

When it comes to storing your cryptocurrencies safely, offline storage options are often recommended. Two popular choices for offline storage are cold wallets and hardware wallets.

A cold wallet is a type of offline storage that is not connected to the internet, making it less vulnerable to hacking or cyber attacks. Cold wallets can come in the form of paper wallets or offline software wallets. Paper wallets are physical documents that contain your public and private keys, while offline software wallets are programs that generate and store your keys on a device that is not connected to the internet.

On the other hand, hardware wallets are physical devices that store your cryptocurrency keys offline. These devices are often considered more secure than cold wallets because they are specifically designed to protect your keys from online threats. Hardware wallets typically look like USB drives and require you to physically connect them to a computer or mobile device to make a transaction.