Understanding Cryptocurrency Wallets: Types and Security Tips

- What is a Cryptocurrency Wallet and How Does it Work?

- Types of Cryptocurrency Wallets: Hot vs Cold Wallets

- Security Risks Associated with Cryptocurrency Wallets

- Best Practices for Securing Your Cryptocurrency Wallet

- Choosing the Right Cryptocurrency Wallet for Your Needs

- The Future of Cryptocurrency Wallets: Trends and Innovations

What is a Cryptocurrency Wallet and How Does it Work?

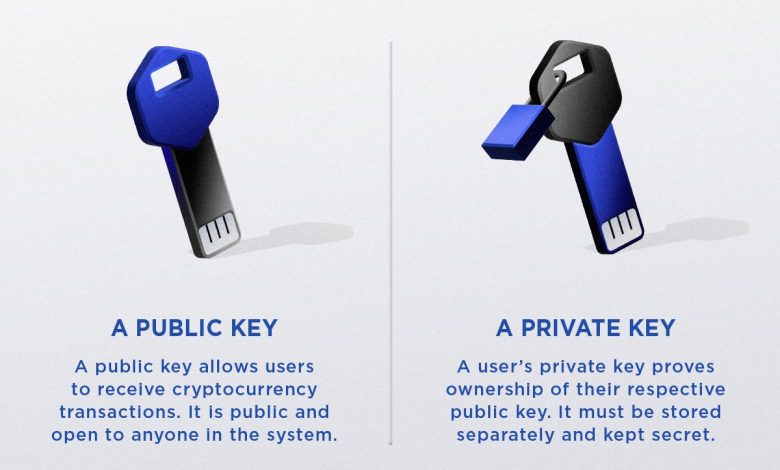

A **cryptocurrency wallet** is a digital tool that allows users to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and others. It works similarly to a traditional wallet, but instead of holding physical cash and cards, it stores cryptographic keys that represent ownership of digital assets.

There are different types of cryptocurrency wallets, including **hardware wallets**, **software wallets**, and **paper wallets**. Hardware wallets are physical devices that store the user’s keys offline, providing an extra layer of security. Software wallets are applications or programs that can be installed on computers or mobile devices. Paper wallets involve printing out the user’s keys and storing them in a secure place.

When a user wants to make a transaction using their cryptocurrency wallet, they need to sign the transaction with their private key. The transaction is then broadcasted to the blockchain network for validation and inclusion in the public ledger. Once the transaction is confirmed, the recipient’s wallet will reflect the new balance.

It is essential to keep your cryptocurrency wallet secure to prevent unauthorized access and potential loss of funds. This can be done by using strong passwords, enabling two-factor authentication, and keeping backups of your keys in a safe place. Additionally, it is crucial to only use reputable wallets and be cautious of phishing scams and malware that could compromise your wallet’s security.

Types of Cryptocurrency Wallets: Hot vs Cold Wallets

When it comes to cryptocurrency wallets, there are two main types to consider: hot wallets and cold wallets. Hot wallets are connected to the internet, making them more convenient for frequent trading and transactions. However, they are also more susceptible to hacking and cyber attacks. On the other hand, cold wallets are offline storage devices that provide a higher level of security since they are not connected to the internet. While they may be less convenient for active trading, they are ideal for long-term storage of cryptocurrencies.

Security Risks Associated with Cryptocurrency Wallets

Cryptocurrency wallets, while providing a convenient way to store and manage digital assets, also come with their fair share of security risks. It is important for users to be aware of these risks in order to protect their investments. One of the main security risks associated with cryptocurrency wallets is the potential for hacking. Hackers are constantly looking for vulnerabilities in wallets to steal funds, so it is crucial to use wallets from reputable providers and keep software up to date to minimize this risk.

Another security risk to be aware of is the possibility of phishing attacks. Phishing attacks involve tricking users into revealing their wallet credentials through fake websites or emails. To avoid falling victim to phishing attacks, it is important to always double-check the URL of websites and be cautious of unsolicited emails asking for personal information.

Additionally, users should be wary of malware that can infect their devices and steal wallet information. It is important to use antivirus software and avoid downloading files or clicking on links from unknown sources to reduce the risk of malware infections. By taking these precautions, users can better protect their cryptocurrency wallets from security threats and ensure the safety of their digital assets.

Best Practices for Securing Your Cryptocurrency Wallet

When it comes to securing your cryptocurrency wallet, there are several best practices you should follow to ensure the safety of your digital assets. Here are some key tips to keep in mind:

- Use a hardware wallet: Hardware wallets are considered one of the most secure options for storing your cryptocurrency. These physical devices store your private keys offline, making them less vulnerable to hacking.

- Enable two-factor authentication: Adding an extra layer of security to your wallet by enabling two-factor authentication can help prevent unauthorized access.

- Backup your wallet: Make sure to regularly backup your wallet and store the backup in a secure location. This will help you recover your funds in case your wallet is lost or damaged.

- Keep your software up to date: It’s important to keep your wallet software up to date to protect against any potential security vulnerabilities.

- Avoid public Wi-Fi: When accessing your wallet, avoid using public Wi-Fi networks as they can be insecure and make you more susceptible to attacks.

By following these best practices, you can help ensure the security of your cryptocurrency wallet and protect your digital assets from theft or loss.

Choosing the Right Cryptocurrency Wallet for Your Needs

When it comes to choosing the right cryptocurrency wallet for your needs, there are several factors to consider. The first thing to think about is the type of cryptocurrency you plan to store. Some wallets are designed to work with specific cryptocurrencies, while others are more versatile and can store multiple types. It’s important to choose a wallet that is compatible with the currencies you plan to use.

Another important consideration is the level of security you require. Some wallets offer more robust security features, such as two-factor authentication or biometric verification, while others may be more basic. If you plan to store a large amount of cryptocurrency or if security is a top priority for you, it’s worth investing in a wallet with advanced security features.

You should also think about how you plan to access your wallet. Some wallets are designed to be used on a single device, such as a computer or smartphone, while others are web-based and can be accessed from any device with an internet connection. Consider how you plan to use your wallet and choose one that fits your lifestyle and needs.

Finally, consider the reputation of the wallet provider. Look for wallets that have a strong track record of security and reliability. Read reviews from other users and do some research on the company behind the wallet. It’s important to choose a wallet from a reputable provider to ensure the safety of your funds.

In conclusion, choosing the right cryptocurrency wallet is an important decision that should not be taken lightly. Consider the type of cryptocurrency you plan to store, the level of security you require, how you plan to access your wallet, and the reputation of the provider. By taking the time to research and choose a wallet that meets your needs, you can ensure that your cryptocurrency is safe and secure.

The Future of Cryptocurrency Wallets: Trends and Innovations

The future of cryptocurrency wallets is evolving rapidly, with new trends and innovations shaping the landscape. One key trend is the rise of multi-currency wallets that support a wide range of digital assets. These wallets offer users greater flexibility and convenience, allowing them to manage all their cryptocurrencies in one place.

Another innovation in cryptocurrency wallets is the integration of biometric security features, such as fingerprint scanning or facial recognition. These advanced security measures help protect users’ funds from unauthorized access and theft, providing peace of mind in an increasingly digital world.

Moreover, the development of decentralized wallets, which do not rely on a central authority to facilitate transactions, is gaining traction. These wallets give users full control over their funds and eliminate the risk of third-party interference or censorship.

Furthermore, the use of hardware wallets, which store cryptocurrency offline on a physical device, is becoming more popular due to their enhanced security features. These wallets are considered one of the safest ways to store cryptocurrencies, as they are not connected to the internet and are therefore less vulnerable to hacking attempts.

Overall, the future of cryptocurrency wallets is bright, with a focus on enhancing security, convenience, and user control. As the industry continues to evolve, we can expect to see even more innovative solutions that make managing and storing cryptocurrencies easier and more secure than ever before.